What is a Crypto Exchange

Let’s start from the basics, the stock market is a centralized marketplace for buying and selling financial instruments like stocks, bonds, and commodities. It includes stock exchanges such as NYSE and NASDAQ for trading stocks, as well as commodities exchanges like NYMEX for trading commodities like gold and silver.

To access the stock market, retail investors need a stock broker, which acts as an intermediary, facilitating transactions between investors and the stock market. These licensed institutions provide services like executing trades, offering investment advice, and providing necessary tools and platforms.

A crypto exchange combines features of both the stock market and a stock broker. Firstly, it creates its own markets, such as BTC/USD, which are exclusive to that particular exchange and somewhat independent from the BTC/USD markets of its competitors. Although these markets are independent from each other, a significant price divergence between exchanges markets can create arbitrage opportunities, which will quickly minimize the price gap/difference between the two.

Arbitrage involves taking advantage of price differences between exchanges. For example, if one exchange offers a lower price for a cryptocurrency, traders can buy it from that exchange and sell it on another exchange where the price is higher, profiting from the price difference.

Second, similar to a stock broker, a crypto exchange also provides the infrastructure for trading within its own markets, as well as education sections, advanced charting tools, staking as a service and unique early investment opportunities for projects backed by the exchange.

Due to the decentralized and international nature of cryptocurrencies, exchanges operate with more freedom and autonomy but any serious centralized exchange with a long-term plan, is and has to follow a conservative KYC (Know Your Customer) and AML (Anti Money Laundering) policy.

What you Need to Know when Choosing an Exchange

Choosing an exchange isn’t like rocket science, it’s a fairly simple process as long as you know what your priorities are: Some users may only want to acquire crypto for self-custody while others may be more interested in active day trading, which requires an exchange with higher liquidity and markets or coin pairs.

Regardless of what you are after here are some basic elements to consider when choosing an exchange:

Spread, Withdrawal & Deposit Fees

In order to maximize the amount of crypto you receive, it's crucial to consider the fees involved. Pay attention to the price spread, which represents the difference between the buying (bid) and selling (ask) prices of a cryptocurrency on the exchange. A smaller spread indicates lower trading costs and better liquidity, indicating active participation from buyers and sellers.

Withdrawal fees can be significant, depending on your investment or trading amount. They include on-chain transaction fees, which vary based on the blockchain's congestion, and the exchange's commission for the withdrawal. Checking these fees beforehand is advisable to avoid surprises, especially when dealing with smaller amounts.

While deposit fees are uncommon, they should be considered when starting with a low amount. Bank transfers to exchanges are generally free but may take a day or two to process, potentially impacting the price you receive once funds are credited. Alternatively, using debit/credit cards allows for instant account funding, albeit with a deposit fee of around 2%, subject to currency variations.

KYC (Anonymity)

When choosing an exchange, it's important to consider the trade-off between centralized exchanges and physical shops in terms of commissions. Centralized exchanges typically offer significantly lower commissions, ranging from around 0.1% to 0.2%, making them a cost-effective option for buying and selling cryptocurrencies.

In contrast, physical shops that offer anonymous crypto purchases (in cash up to 1000$) often charge much higher commissions, averaging around 10%.

Decentralized exchanges, that require no KYC, have a very competitive spread and fees compared to the traditional exchanges with KYC, but you still have to find a way of depositing fiat funds (which can only be through centralized exchanges or physical shops / crypto ATM’s).

While physical shops may provide immediate access to cryptocurrencies, the substantial commission fees can significantly impact the overall transaction cost. On the other hand, centralized exchanges offer competitive commissions, providing a more affordable avenue for crypto trading. Considering your priorities and cost considerations will help you make an informed decision when choosing between centralized exchanges and physical shops.

Reputation

Reputation plays a crucial role, although it's important to acknowledge that it can be challenging to find an exchange without any faults or instances of ill-intentioned FUD (Fear, Uncertainty, and Doubt) circulating around it. Competitors and disgruntled former customers who may have experienced issues such as blocked accounts or freezes due to suspicious transactions can sometimes spread negative narratives.

However, despite these challenges, it's still valuable to consider the overall reputation of an exchange. Look for exchanges with a track record of reliability, security, and transparency. Research user reviews, industry feedback, and any regulatory compliance records to gain insights into the exchange's credibility. Additionally, consider the exchange's response to past incidents and how they have addressed and resolved customer concerns.

By taking a balanced approach and conducting thorough research, you can form a more informed judgment about an exchange's reputation, allowing you to make a better decision when choosing the right platform to engage in cryptocurrency trading.

Centralized vs Decentralized

Cryptocurrency exchanges can be either governed by some entities or can be completely decentralized, i.e. governed on the blockchain. A cryptocurrency exchange governed by some entity is called a centralized cryptocurrency exchange (CEX). Whereas, an exchange governed over the blockchain is a decentralized crypto exchange (DEX). Both of these exchanges have their advantages and disadvantages.

Centralized Exchanges

Some of the examples of a centralized crypto exchange are Binance, eToro, Huobi Global. Whereas UniSwap, PancakeSwap, CoinMama, SushiSwap, QuickSwap are some of the most prominent decentralized exchanges.

Decentralized Exchanges

Top Crypto Exchanges for Gambling

-

BitStamp (Easiest, No Limits)

-

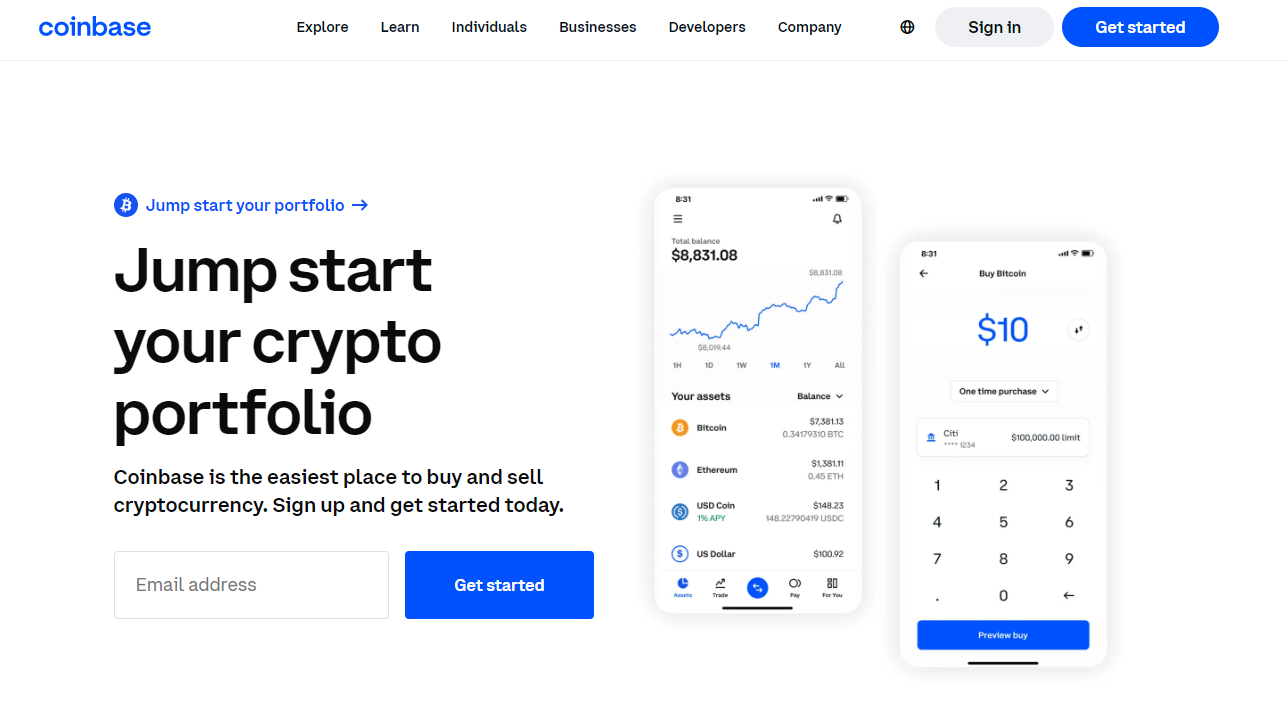

Coinbase (Renown, easy to use)

-

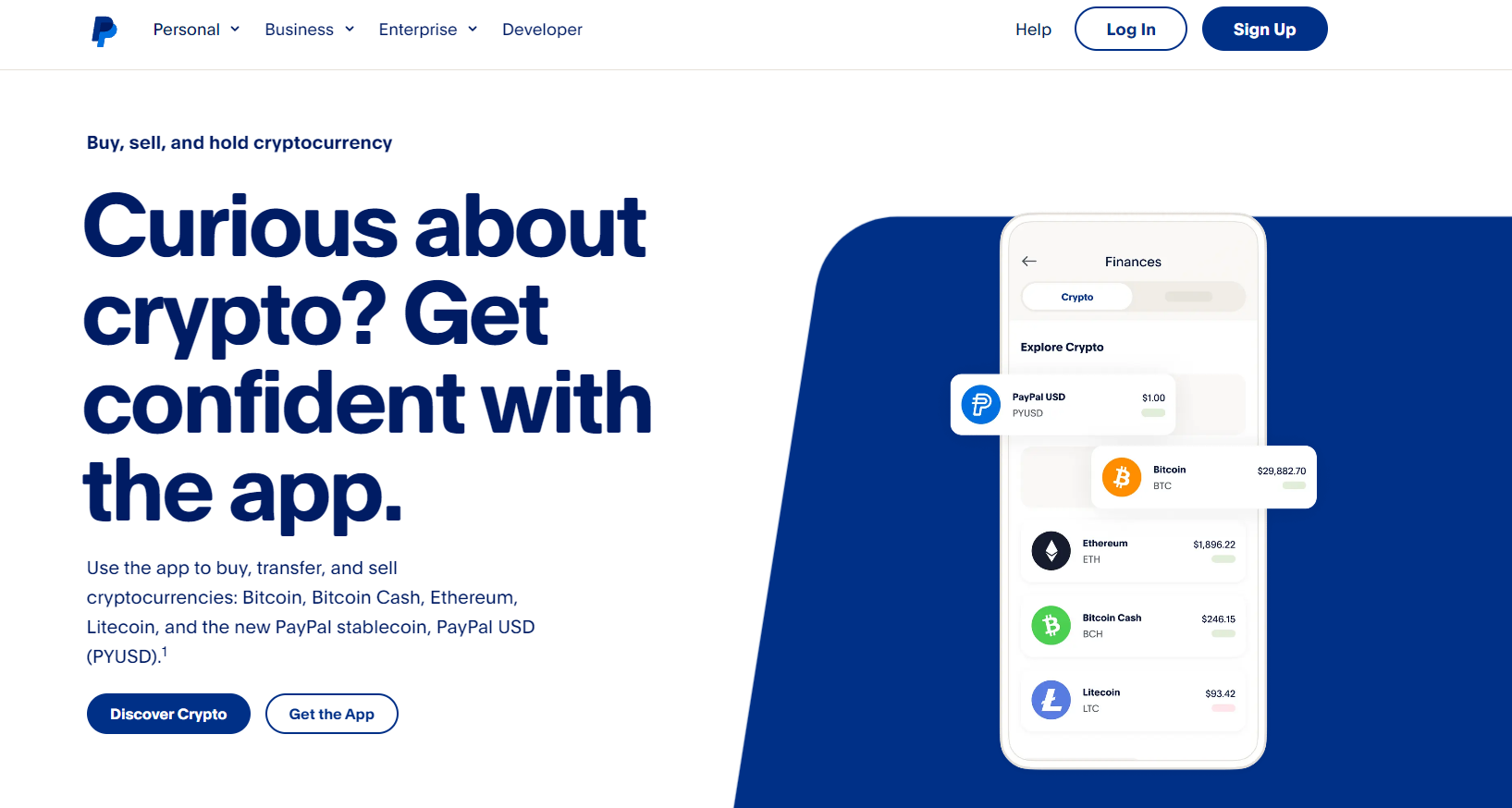

Paypal P2P (Convenience, Trustable)

-

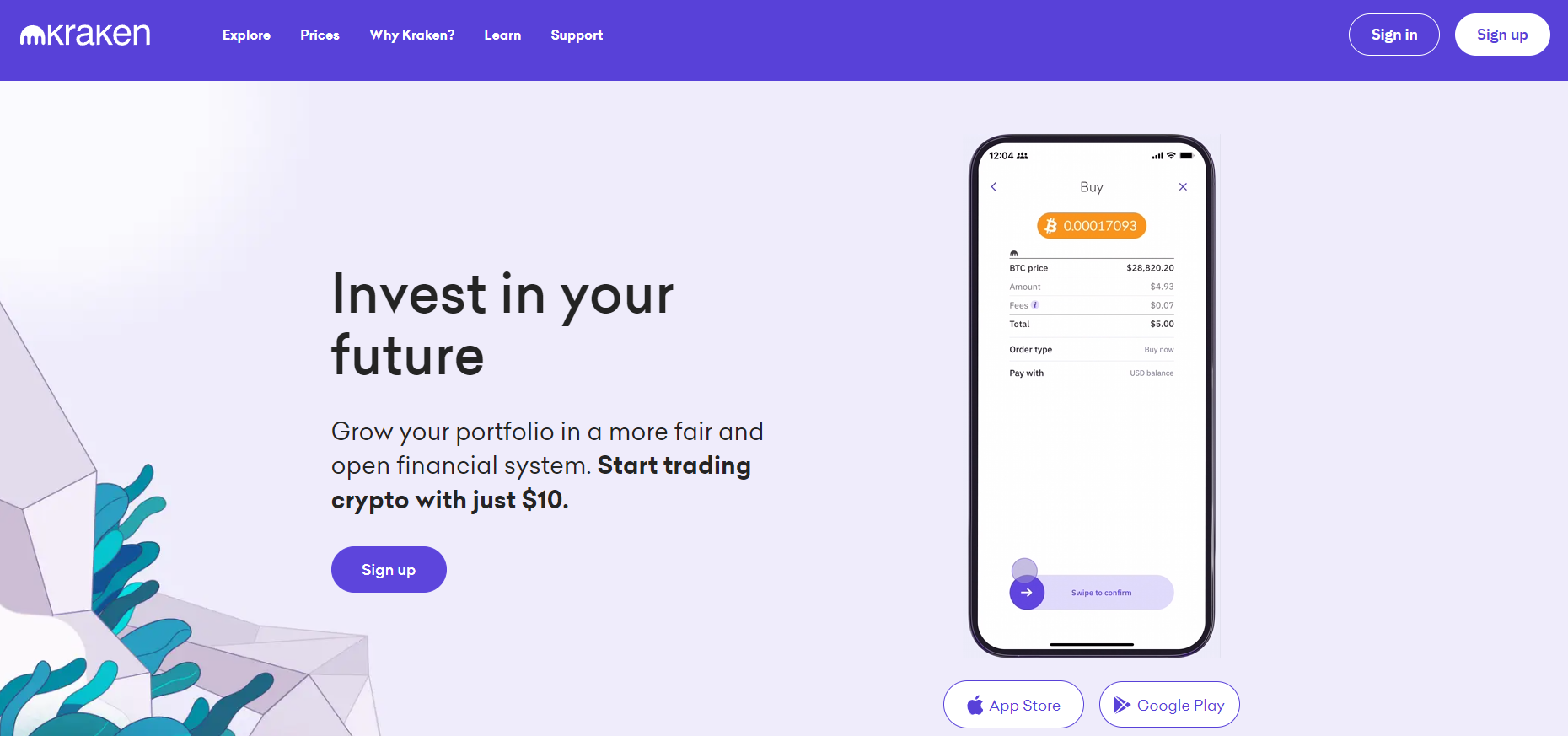

Kraken (Renown)

-

Binance (Renown)

-

Crypto.com (Renown, Convenience)

-

Kucoin (Renown)

-

Bybit P2P (Anonymity)

-

CEX.io (Simplicity)

-

UpHold (Variety)

-

Gate.io (Renown, Variety)

BitStamp|User-friendly + Simple

Bitstamp is one of the most popular crypto-converting to tools because of its low trading fees, easy-to-use service, and the fact that it's plugged into hundreds of crypto casinos, and crypto focused platforms. Their service proves efficient and cheap to the average user.

Although there's only a limited amount of tokens available, they cater to a massive audience. Their license means only a few countries do not allow their services. Making it one of the best options for crypto to fiat withdrawals.

Coinbase

For most of us Coinbase was the first entry gate into the crypto world. The Nasdaq listed exchange is a good option for beginners while also offering a complete set of tools for more seasoned traders.

Coinbase started back in 2012 and is now headquartered in the state of Delaware, for obvious reasons. One of its coolest features is the learn to earn section where users automatically earn a small amount of different cryptocurrencies by learning about various projects and answering a small quiz.

The exchange offers a basic mobile app for beginners where they can buy cryptocurrencies almost instantly at the touch of a button and advanced tools for chart analysis and multiple types of orders to get the best price execution. Additionally users can order a debit card to pay everyday purchases with crypto, buy NFT’s on their dedicated marketplace, borrow money using their portfolio as collateral and stake their crypto for passive returns.

PayPal Crypto

The only way you wouldn't have heard of PayPal is if you were living under a rock. The popular payment is international, relatively cheap, and extremely convenient. Although they've only offered crypto trading in the last year and a bit, the company is reputable, with a market cap of $78,39 Billion. With such a simple system catering to almost every country on earth, why not use it?

The main unfortunate drawback of Paypal crypto services is that it is only available for US residents and it still remains to be implemented in other countries.

Kraken

Kraken is even older than Coinbase, founded in 2011, with headquarters in San Francisco, the exchange has similar features to Coinbase regarding the mobile beginner solution and advanced platform, NFt marketplace and staking.

There is however a feature that differentiates Kraken from the most established competitors: Margin trading, which is only available to non-US citizens, allows traders to leverage their account and to buy on margin, meaning traders can buy significantly more than what their account is worth. This usually is set up by allocating funds from your portfolio as collateral, and buying up to 5x times the value of such an amount. This significantly maximizes profit and losses so it is advisable to start with a demo account to understand how quickly you can lose or multiply your account value.

Yes, Bybit and Bitmex have been the pioneers on crypto margin trading but they also lack the trustworthiness of an established exchange. Furthermore their trading tools are provided “as is'' meaning the user accepts the outcome of any technical problems that might happen: In times of high volatility these platforms has been known to be unresponsive, meaning that your time sensitive orders do not get executed, effectively blowing up your account if you are highly leveraged.

Binance

Registering with Binance is a wise choice due to its high liquidity, renowned presence, and strong reputation. As one of the largest cryptocurrency exchanges globally, Binance offers a vast pool of liquidity, ensuring efficient trading with minimal slippage. With a proven track record and commitment to security, Binance has built a trustworthy reputation in the industry. The exchange's inclusive community, diverse range of cryptocurrencies, and continuous innovation further solidify its position as a top choice for traders and investors.

Crypto.com

Formerly known as Monaco, Crypto.com slowly became one of the most popular exchanges through their product offerings. It is one of the first exchanges to have shipped crypto cash back debit cards worldwide and the biggest crypto sponsor of sports events such as the UFC, Formula1 and NBA/NHL through the acquisition of the Crypto.com Arena formerly known as Staples Center.

Crypto.com currently has over 80 million users worldwide and features a user-friendly mobile app for trading, lending, NFT purchases and portfolio management. Just like any reputable exchange it also has a full site with advanced trading tools for more experienced users that includes margin trading, Futures contracts and bot trading.

A final notable mention is its Dollar Cost Averaging bot which allows users to set up a bot that executes regular purchases of a basket of selected cryptocurrencies with the funds deposited.

Kucoin

Launched in 2017, the Seychelles headquartered exchange is one of the most complete exchanges rivaling Binance in terms of services and perks offered.

Kucoin stands out in two particular aspects, the first one being the number of countries it services directly and through third party vendors. Most exchanges are only a good option for a small niche of countries but Kucoin accepts 50 fiat currencies thanks to its partnerships and claims to service 200 countries.

The second strong point of Kucoin is the diverse services it offers, aside from spot and derivatives trading, Kucoin offers staking of cryptocurrencies (on exchange and self staking with their non custodial wallet), lending, Defi liquidity providing, a NFT store and even fractional ownership of blue chip NFT’s.

Bybit P2P

Bybit started their service just a few years ago (2018) but quickly became one of the big names in the crypto trading business. They offer quick and efficient service, and almost every new cryptocurrency hopes to list its token on Bybit.

Their P2P service is one of the more popular options due to its anonymity, no trading fee, and easy/safe connection. The main option users opt to take is the "escrow" payment system. Meaning that Bybit plays the middleman. The seller sends their currency to Bybit, and the buyer adds the fiat funds to Bybit. Once both parties make their payments, Bybit automatically distributes the payments.

From 0 fees, constant promotions and affiliate programs, and almost no controversy surrounding the platform, they are the best P2P service in the business.

CEX.io

Cex.io is a very well-known crypto exchange with over 4 million users. They include options for staking, and implementing multiple payment methods and haven't experienced any known mass exploitations showing they're capable of preventing hacks. They were happy to oblige with Proof-of-reserves recently as well showing they handle customer funds correctly. Their website is extremely user-friendly, and they include multiple warnings and systems to ensure you handle your funds correctly for withdrawals.

Uphold

Uphold was not initially created for cryptocurrencies as they're a stock trading platform. But in 2015 they started allowing users to invest into digital currencies such as Bitcoin and Ethereum. Since then they've branched out with over 210 tokens to choose from.

What makes Uphold great is you can sell your crypto and send it right into the newest stocks or even safer investments like precious metals. Overall their system is trustable and their UI is extremely user-friendly.

Gate.io

Founded in 2013, Gate.io is one of the oldest continuously operating crypto exchanges, offering a wide range of features tailored to both new and seasoned traders. While its interface may feel overwhelming for beginners, it makes up for it with an impressive suite of tools: spot and futures trading, copy trading, leveraged tokens, and even crypto ETFs.

Gate.io also boasts one of the most extensive token listings in the industry, often supporting new and obscure projects before larger exchanges do. Its Launchpad and Startup platform offers early access to token sales, making it appealing for investors seeking high-risk, high-reward opportunities in emerging crypto ventures.

Rising Stars: Top New Crypto Exchanges to Watch

Strike

From Jack Mallers and Zap, the lightning payment company, comes Strike, a centralized Bitcoin-centric exchange that offers far more value than traditional crypto exchanges.

Strike is available in over 100 countries, enabling users to buy and sell Bitcoin with ease. It offers free on-chain withdrawals, lightning payments, and cross-currency transactions over the Lightning Network—think of it as a global Revolut or Venmo for Bitcoin. With Strike, you can receive payments, including P2P, in your local currency or BTC. Plus, the in-app shopping section lets you purchase goods from Bitrefill.

Strike combines innovative features with seamless usability, revolutionizing the way you interact with Bitcoin, and hopefully will push traditional exchanges to improve their services by adopting the lightning network and offering free withdrawals.

Swan Bitcoin

Swan Bitcoin simplifies Bitcoin accumulation with a focus on significant investments. The platform offers instant purchases, recurring buys, and free withdrawals, with a modest 0.99% fee applied only after your initial $10,000 in purchases.

Swan Bitcoin caters to individual investors and provides specialized services for High Net Worth individuals, private institutions, retirement accounts, and offers a vault service for deposits exceeding $250,000. This includes managing one of the three multisig keys on behalf of clients.

In addition to financial services, Swan Bitcoin offers educational resources to enhance users' understanding of Bitcoin investment, fostering a community of informed investors.

While Swan Bitcoin operates as a fully compliant centralized exchange, their introductory offer allows for purchasing $10,000 worth of Bitcoin without fees, alongside free withdrawals. This makes Swan Bitcoin particularly appealing for medium to large-scale gamblers in the crypto space. Investors can allocate $25,000 worth of BTC, retain a portion for long-term storage, and regularly transfer the remainder to various crypto gambling platforms without transaction fees.

Top 5 No KYC Exchanges

-

Bisq

-

HodlHodl

-

Robosats

-

Peach Bitcoin

-

Vexl

Bisq

Bisq is a decentralized exchange that has steadily gained traction among privacy-conscious cryptocurrency traders since its launch. As a peer-to-peer (P2P) platform, Bisq operates without a central authority, allowing users to buy and sell Bitcoin and other cryptocurrencies directly with one another. The standout feature of Bisq is its commitment to anonymity—there’s no need to provide personal information or undergo KYC checks, making it an ideal choice for those who prioritize privacy in their transactions.

The platform uses a decentralized network and Tor to protect users' identities and prevent censorship. Bisq also employs a multi-signature escrow system, ensuring that both parties in a transaction are protected. The buyer sends fiat funds directly to the seller, while the seller's Bitcoin is held in escrow until the payment is confirmed, minimizing the risk of fraud.

Despite its decentralized nature, Bisq is surprisingly user-friendly, offering a straightforward interface for both new and experienced traders. The platform is open-source and community-driven, with regular updates and improvements contributed by users worldwide.

Bisq may not offer the high liquidity or wide range of altcoins found on centralized exchanges, but for those seeking a secure, private, and decentralized way to trade, it's one of the best options available.

HODLHODL

HodlHodl is a peer-to-peer, non-custodial cryptocurrency exchange that focuses on user privacy by eliminating the need for Know Your Customer (KYC) procedures. This means that users can buy and sell Bitcoin without disclosing personal information or undergoing identity verification, making it an excellent choice for privacy-conscious traders.

What sets HodlHodl apart is its use of multi-signature escrow contracts, where the platform acts as a neutral third party in transactions. When a trade is initiated, Bitcoin is held in a multisig escrow wallet until both the buyer and seller confirm the payment has been made. This system significantly reduces the risk of fraud while ensuring that HodlHodl never controls users' funds directly, enhancing security and decentralization.

HodlHodl supports a wide range of payment methods, including bank transfers, PayPal, and various other fiat options, giving users flexibility in how they complete their transactions. The platform is easy to navigate and caters to both beginners and experienced traders alike, offering a streamlined trading process without the typical complications of a centralized exchange.

While HodlHodl does not offer the same level of liquidity as larger exchanges, its emphasis on privacy, user control, and non-custodial trading makes it one of the best anonymous non KYC exchanges available for those who value these principles.

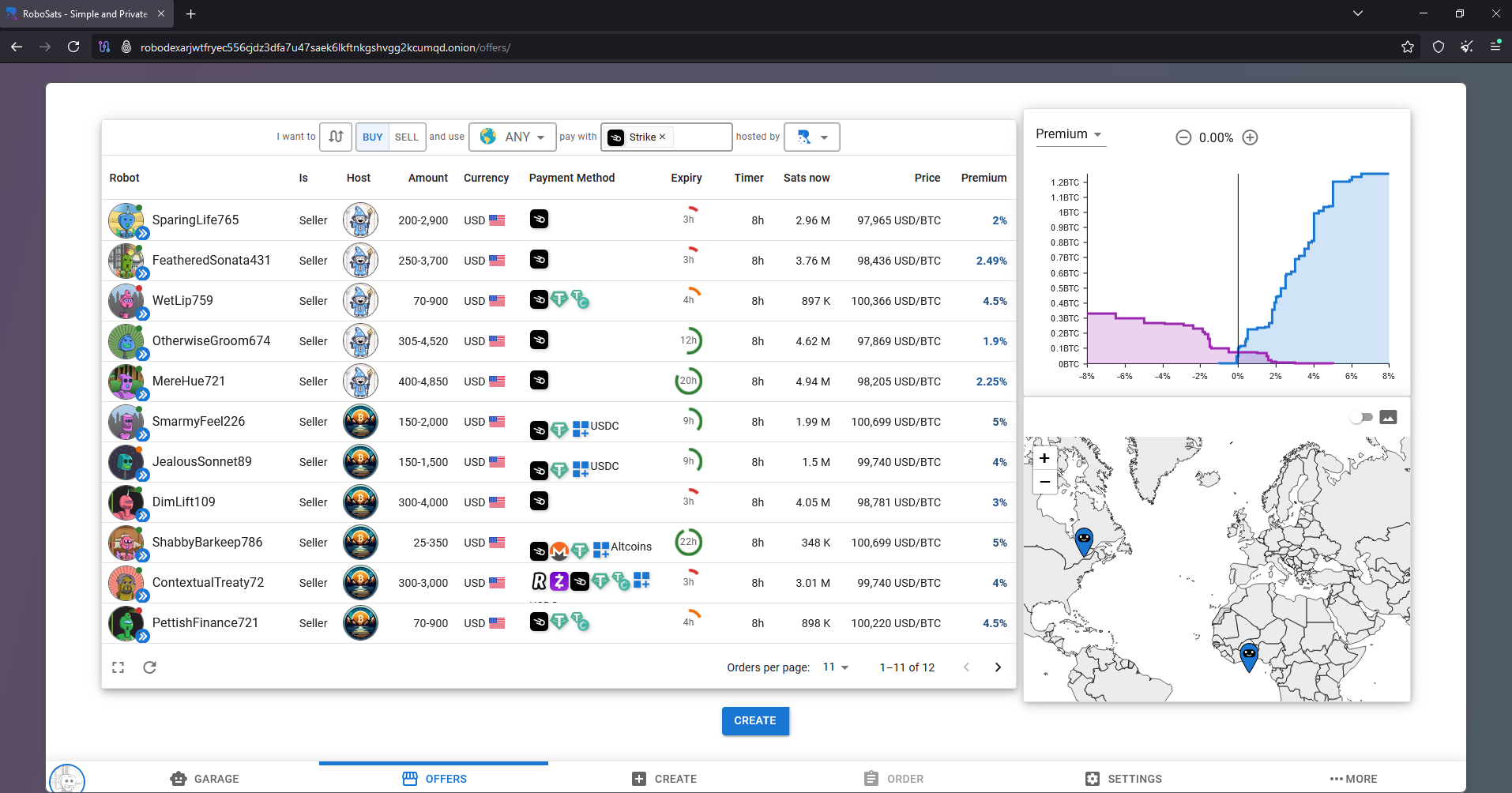

Robosats|No KYC, Anonymous Bitcoin Exchange

Robosats is a decentralized, peer-to-peer Bitcoin exchange designed for privacy-conscious users. The platform stands out by offering a no KYC exchange, meaning users can trade Bitcoin without having to submit personal information or go through traditional identity verification. This makes Robosats an appealing choice for those seeking anonymity in their crypto transactions, including users in the gambling community who prefer to keep their crypto activities private.

One of the core features of Robosats is its commitment to privacy and security. It operates entirely over the Tor network, which ensures that all communications between buyers and sellers are encrypted and anonymous. By routing traffic through Tor, Robosats shields both parties from surveillance, making it an ideal exchange for anyone looking to avoid tracking or monitoring from both governments and centralized authorities.

To use Robosats, you'll need to download the Tor Browser to access the Robosats onion. Unlike traditional exchanges, Robosats is a decentralized no KYC exchange, which will assign you a different account identity when you access it (You can still access your previous account identities if you choose), making it a truly anonymous exchange. Once you have your identity, you can start trading Lightning Bitcoin directly with other users, using various payment methods such as bank transfers, gift cards, or even cash, all while remaining completely anonymous.

The peer-to-peer nature of Robosats ensures that there’s no central authority controlling the transactions, and the platform acts merely as an escrow service to guarantee security and fairness. As a crypto exchange for gambling, Robosats is particularly beneficial because it enables users to maintain privacy when converting funds for gambling purposes, which often involves avoiding the scrutiny of banks or regulators.

Peach Bitcoin

Peach Bitcoin is a decentralized peer-to-peer Bitcoin exchange launched in 2022, ideal for users seeking a no KYC exchange. Designed to prioritize privacy and user control, Peach eliminates the need for identity verification, offering an anonymous exchange where traders can buy and sell Bitcoin directly through a mobile app. The platform combines user-friendly design with advanced privacy features like encrypted communications and optional Tor routing, making it an attractive option for those exploring how to buy cryptos anonymously or seeking crypto exchanges for gambling.

Unlike centralized platforms, Peach Bitcoin does not hold user funds. Instead, it uses an escrow service to secure Bitcoin during transactions until payment is confirmed. This decentralized approach ensures security while maintaining user independence. A variety of payment methods, such as bank transfers, mobile apps, and even cash (in person or by mail), add flexibility, making Peach Bitcoin a contender among the top crypto exchanges for privacy-conscious traders. While it may lack the liquidity of larger platforms, its dedication to privacy and ease of use make it a standout choice for those prioritizing anonymity.

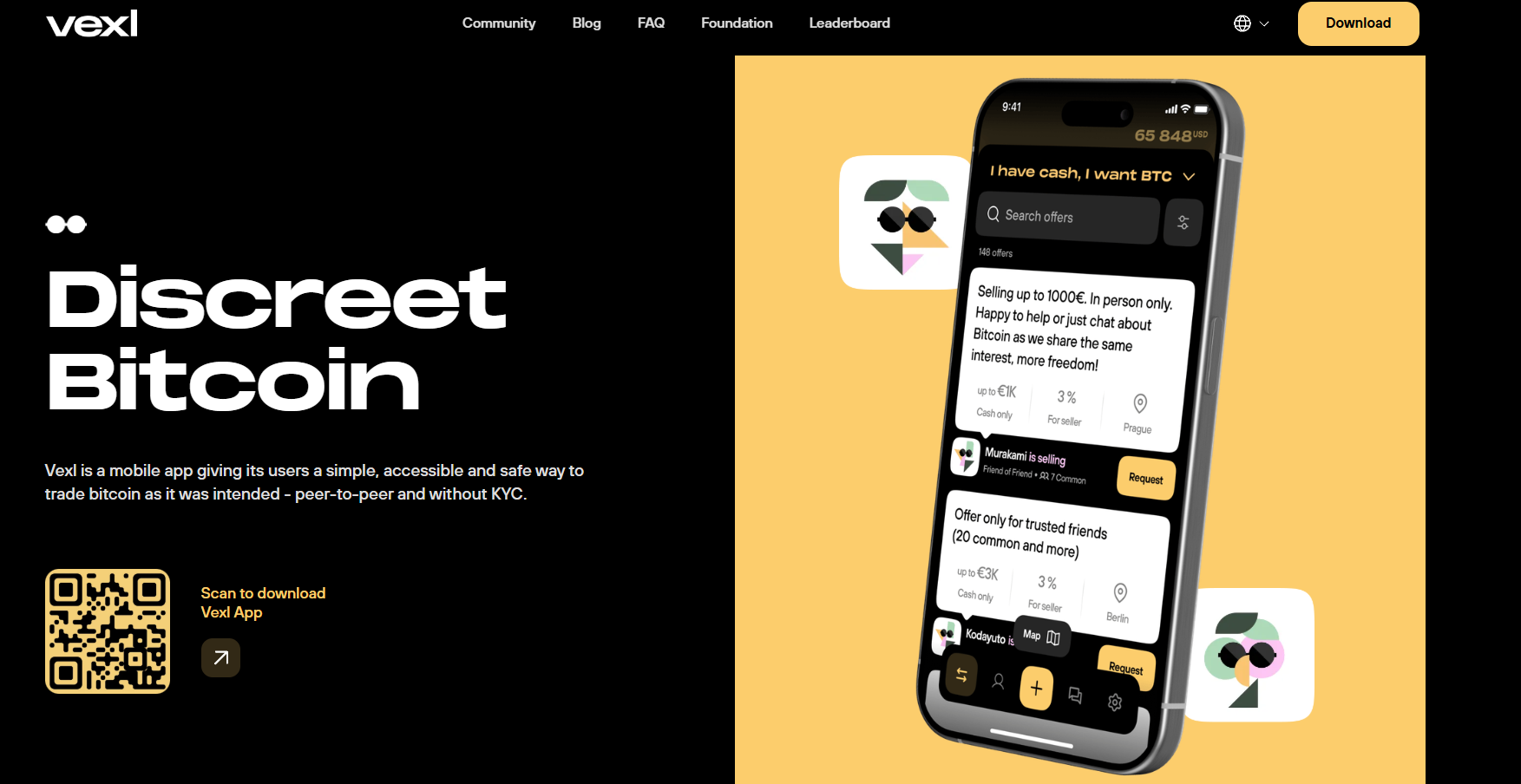

Vexl

Vexl is a peer-to-peer Bitcoin marketplace that offers a unique blend of privacy, security, and gamified networking. Vexl is a no KYC Exchange, allowing users to trade Bitcoin P2P anonymously. However, what truly sets it apart is its social approach to trading—users can only see offers from their friends and friends of friends, creating a trust-based network that enhances security while adding a networking element to the experience.

By restricting visibility to a user’s extended network, Vexl reduces the risk of scams and fosters a more reliable trading environment. This also turns the app into a kind of Bitcoin social network, where users expand their connections while engaging in secure, peer-to-peer transactions.

Vexl is mobile-first, featuring an intuitive app that makes trading Bitcoin effortless. It supports a variety of fiat payment methods, including bank transfers and cash deals. Transactions are protected through an escrow system, ensuring that Bitcoin is only released once the payment is confirmed. Additionally, the app does not require email registration, and all communications are end-to-end encrypted, further enhancing user privacy.

While Vexl may not have the broad liquidity of open-order-book exchanges, its innovative trust-based model, privacy focus, and ease of use make it an excellent choice for those looking for a secure and social way to trade Bitcoin.