Commodity Money

As humans settled in different points on the planet and started interacting with other communities, came the need for a tool for commerce. This new tool came in many forms and sizes from wheels of stone to seashells, and from glass beads to bullshit, to be more precise Yak dung; while there many different iterations, the most successful ones had a few common traits:

This new invention called money must be able to do 3 basic functions; facilitate exchanges, act as a store of value and act as a unit of account meaning prices can be set in units of that particular type of money.

In order to do this 3 basic functions these prospective tools must be divisible, portable, durable, salable (easily accepted, recognized and trusted), scarce (cannot be easily mass produced) and finally fungible (meaning all units of the money are equal and interchangeable between each other). Additionally, commodity money must also have intrinsic value based on its physical properties. Most earlier attempts fell due to the liability of lacking one or more characteristics:

Micronesian Rai Stones, mined and carved in a far away island failed in most characteristics of money but mostly because of the interaction with foreigners who found the way to “counterfeit” or mass produce them easily with their advanced vehicles and technology. African glass beads or Trade beads, were more portable than Rai stones but they were easily manufactured/counterfeited in Europe and eventually abandoned.

While all the iterations of Money need to fulfill the functions and characteristics we mentioned earlier, the number 1 reason why currencies fail is quite straightforward, excessive supply increases by the main issuing entity (printing/minting) or a third party (counterfeiting); and this is where precious metals come into play.

Precious Metals and their History

The first recorded currency was seashells. The oldest coins discovered date back to the 8th century BC. The use of gold as money however began around 600 BCE in Asia Minor. Often it’s associated with the legendary Phrygian King Midas with Golden Touch. Interestingly the first coins were made of electrum, a naturally occurring alloy of gold and silver but of variable precious metal value. The following centuries coins became the main means of transactions around the civilized world.

Probably the coin which can be considered the equivalent of the US Dollar and the first global coin is the Roman denarius which was made of silver. Sestertius, the Roman golden coin was too expensive to be circulated as much and the bronze or copper assarius was too cheap. The Byzantine continued the Roman tradition with golden solidus or bezant being used around Europe and the Mediterranean.

Other empires followed this example with Charlemagne’s Holy Roman Empire introducing the silver penny or denier and much later the Conventionsthaler and Reichsthaler, both made of silver. The Spanish Empire minted the silver Spanish dollar also known as piece of eight which many consider the actual first international coin.

Interestingly, one of the reasons the Spanish Dollar became so popular it’s because it was used to pay Spanish soldiers in the New World, the conquistadores. Silver is also a well-documented antimicrobial that has been shown to kill bacteria, fungi and certain viruses. The Spanish knew that so soldiers could use their coins to clean water they would drink from. Five hundred years ago that was a very good reason to carry silver.

The British Empire followed this example and started minting gold coins early on. The guinea was first minted 1663 and it would continue doing so every year until 1814 when it was replaced with the sovereign, a gold coin with a nominal value of one pound sterling but much higher actual value. The sovereign is still very popular today.

While counterfeits do exist, its very widespread usage has made the coin easy to identify and till today it's a favorite of anyone interested in investing in gold. Its weight and dimensions are standard so even someone with little experience can identify a genuine from a fake one. A genuine Gold British Sovereign must weigh 7.9 grams, have a diameter of 22mm. and a thickness of 1.5mm.

Gold and Silver have been used as currency for millennia. However, their historical adoption was not without challenges. With the discovery and exploitation of new mines and the expansion of states through colonization and resource depletion, the supply of these metals exhibited significant fluctuations.

Over the course of centuries, several nations, including China and countries in the Middle East attempted, but ultimately failed in their experiments with paper money. Some even resorted to issuing Fiat currencies through gold/silver coins whose value was dictated by the issuing government rather than the intrinsic precious metal content (textbook Fiat money or money by decree).

It wasn't until the 20th Century that paper currency emerged as the predominant form of money. Initially backed by gold, this approach changed when governments realized the amount of resources needed for the World War effort, taxation was enforced but they also used a stealthier approach of suspending the gold standard and effectively diluting the purchasing power of their citizens through monetary inflation.

Following World War I, attempts were made to reinstate the gold standard but the high level of debt and inflation didn’t allow them to go back to pre-war gold values. Certain countries returned to the gold standard at adjusted exchange rates, while others embraced variants like the gold exchange standard, where currencies derived backing from both gold and foreign exchange reserves.

At a first glance, gold seems like a terrific asset to hold in between World Wars, but we have to acknowledge the fact that in the Land of the Free, for a brief period of time, owning gold was illegal: In 1933, President Franklin D. Roosevelt issued Executive Order 6102, which required U.S. citizens to turn in most of their gold coins, gold bullion, and gold certificates to the government. A year later, the Gold Reserve Act was passed, which devalued the U.S. dollar and changed the official price of gold: US citizens were forced to hand over their gold at $20.67 per troy ounce and a year later they were free to purchase gold at $35 per troy ounce.

By the beginning of World War II in 1939, most major economies had already abandoned the gold standard due to its constraints. The war further disrupted global economic equilibrium giving birth to the Bretton Woods Conference in 1944 and a new international monetary framework centered on fixed exchange rates tied to the US dollar. The dollar was chosen as the reserve currency because it was pegged to gold. Many European countries had given their gold to the US for safekeeping and received US dollars in return, which could be exchanged for gold.

This arrangement ended in 1971 when President Nixon stopped allowing the conversion of US dollars into their equivalent value in gold, effectively ending the US gold standard. Three years later, the dollar established itself as the Petrodollar, the only currency states could use to buy crude oil.

Today, all nations mint gold, silver or other precious metals coins. However, these are mostly collectibles to commemorate a specific anniversary and unlike coins minted in the past their purpose isn’t to be used for regular transactions.

If you want to learn more about gold and silver we recommend watching Mike Maloney’s mini series Hidden Secrets of Money on YouTube.

The Case Against Precious Metals

Precious metals were the base of human transactions for millennia but recently we stopped. They are available for those interested but unless you go to certain stores or exchanges, you won’t be able to use them. Why is this?

Safety - Storage

Like Bitcoin, transactions in gold or silver coins are almost irreversible, same like cash. If you give someone in the street $10 and they run away, your money is gone. Similarly, if you pay someone a gold guinea and expect five silver pennies as change but they run away, your change is gone. That’s why centralized banking became so widespread as it acts as a guarantor.

In addition to that, storing precious metals isn’t easy. Bank accounts can’t hold them meaning you will need a safe deposit box. If you rent one in a bank, then you have limited access to it as you can’t go overnight to pick up some pieces of eight. If you buy and install a vault at home, this creates other problems. Someone from the vault company might pass your details to some dodgy individuals making you a target. This isn’t so far fetched as lately owners of precious metals and coins have been tortured by robbers to reveal their possessions. Lastly, let’s not forget the cost of a good vault in addition to the space needed.

Summing up, storing precious metals can be dangerous and expensive.

Value

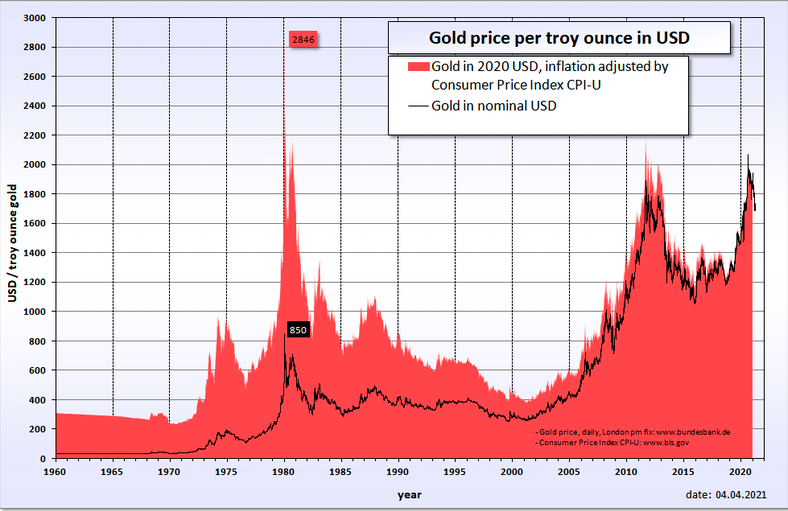

With financial crises hitting the globe one after another, precious metals' value has gone up. The Weimar Republic-like inflation post Covid has also helped a lot. While at the moment gold seems like a safe investment, there is no way of knowing that. Precious metals are a safe haven for times of crises but that doesn’t mean their value can’t also fall.

Nevertheless in the long run their value will most likely go up. No matter what happens with inflation or cryptos, metals are needed for mobile phones, computers and other electronic devices which we use. Let’s not forget how Tesla had problems manufacturing its batteries when the government of Bolivia decided to control the production of lithium. Lithium is necessary for batteries but gold for example is commonly used on mobile phones and their popularity doesn’t seem to be slowing down.

Fungibility - Transportation

Nowadays using precious metals for payments isn’t easy. Stores don’t accept it therefore you must exchange your coins with fiat money to be able to use it. That can be done in a bank, a pawnshop, a collector’s store or in an individual basis as there are many websites where potential sellers and buyers are connected.

The most profitable but risky is the individual basis since after the transaction returns are rarely accepted. If you have been scammed, you can’t get your money back. The bank is safe but it's expensive to buy and cheap to sell so not advisable. In essence the guarantee and availability banks provide costs a lot.

The best option is probably the pawnshop or collector’s store. With a quick online research you will find a few available in your local area. Visit a few, test them, compare prices, services and products and find one with whom you can forge a relationship.

Beware of who you buy from, as there are countless fake gold bars and coins with even the identical design and packaging from the respective mint. This fake gold is often Tungsten plated with a minimum amount of gold which has a negligible value. Also beware of old coins that have no numismatic value, even though they might be original they can easily be a few grams lighter than they should, it may not seem much but a gram of gold is currently a little over $60 and it may add up to a significant sum if you are buying several coins.

At this point we must add that transportation can be an issue. Silver in particular requires a lot of space to be stored. If one day you want cash in, it’s highly possible you will need a cart. Gold is much more expensive therefore light to carry but it can also have the same issue.

Age

Another argument which is often brought up from crypto enthusiasts is that metals are outdated. They have been in use for thousands of years and in our digital age there is no space for them. Plastic dominates today and we always aim at making things lighter and cost-effective. Metals are heavy, expensive to process and difficult to recycle. Why keep using them?

It’s a valid point but sometimes in order to deal with modern problems old solutions can help. An important reason for storing precious metals is that no matter what happens you can always exchange them quickly for cash in case of an emergency. Credit cards can be blocked, so can online wallets and other payment methods, but metals and cash can’t, for now.

The Case for Precious Metals

The aforementioned arguments are correct but are missing the bigger image. Precious metals and expensive coins are a great alternative to cryptocurrencies as a backup in case of monetary or financial crises. They are not competing, they are complementary.

The market can behave in mysterious ways. The price of gold might go up, oil might go down and Bitcoin might go to the moon. Holding different assets offers additional protection. Whether one should prioritize crypto or metals is something that depends on personal needs. To some people cryptocurrencies seem more complicated while others have no space to store precious metals.

When it comes to metals and coins being obsolete, that’s actually an advantage. As previously mentioned and as the Canada convoy protest proved, the government can block your bank account anytime. Crypto can still be used to bypass regulations but that can also be potentially blocked. Precious metals and coins are still legally exchanged to cash and it's 100% anonymous. In a way it’s like the out-dated and under equipped Taliban defeating the mighty United States.

Lastly, as with Bitcoin the amount of gold existing in this world is finite. New veins can be discovered but unless we start exploring planets and asteroids, the supply in the market isn’t expected to rise considerably. On the other hand due to its usage in microchips and other modern devices, demand is expected to increase. Investing in gold or other precious metals can have a nice return in the coming years and decades. And that without taking into consideration the current massive inflation. Fiat currencies' are losing value rapidly due to the effect of the Covid-19 bailouts. Gold-backed cryptocurrencies like Tether Gold or Goldcoin can offer an answer to both cryptos' steep price changes and fiat currencies' gradual devaluation.

And let’s not forget that if space is an issue, instead of buying plain metal, rare coins will serve you well. Their price depends on both the value of the metal the coin is made of and its collectability. A fairly large but still easily careable coin can be worth tens of thousands of dollars instead of a few hundreds. One option is ancient coins where you must beware of forgeries. Modern collectibles can also hold great value, often surpassing ancient coins.

Broken Money & BRICS

In the aftermath of Russia's invasion of Ukraine, the US arguably broke the very concept of money. You see, hard money, also known as sound money, held a high value as a form of currency as it didn't require placing trust in a government to back the value with gold or silver. These metals possessed intrinsic value that couldn't simply vanish, be eradicated, or seized—certainly not without violence.

When the US and its allies made the decision to seize Russian assets, including gold reserves, and subsequently remove them from the SWIFT payment system, a clear question was placed on the mind of nations around the globe: Are our National reserves at risk if we don’t follow the American agenda?.

Upon reflection, you'd come to realize that money can't be arbitrarily turned off by a single entity (at least not hard money), national reserves shouldn't be subject to confiscation (despite centuries of pillaging) and that holding substantial sums of currencies or gold within foreign territories and entities can be a liability. Ultimately, a country’s sovereignty is significantly influenced by the currency you opt for (or are forced to use) in transactions.

BRICS: Fiat, a new Gold Standard or Bitcoin?

Back in 2009, the first BRICS summit convened, featuring Brazil, Russia, India, China, and South Africa. This gathering was initially focused on foreign investment strategies and international cooperation. Fast-forward to the present day, the recent BRICS summit introduced a fresh de-dollarization strategy, advocating for international trade to be conducted through the respective local currencies. Alongside this, there emerged a novel multipolar worldview—one that effectively curtails the reigning era of the Petrodollar wielded by the United States.

While an official proposal for the creation of a new currency by BRICS still hasn’t occurred, several analysts speculate that the alliance might lean toward implementing a currency backed by gold or even explore the use of Bitcoin for settling international trade transactions (although BTC may still be too young and unstable for it).

Moreover, in a significant development, Egypt, Ethiopia, Argentina, the UAE, Iran, and Saudi Arabia are joining BRICS as of January 1st, 2024. Adding to this momentum, another 17 nations have sought membership, among them Venezuela—yet another country that faced a portion of its gold reserves being seized in the UK. In the approaching 2024 BRICS framework, these nations will wield control over nearly 80% of global oil production, a substantial share of food production, and a significant portion of the overall global GDP. This poses a serious challenge for the Petrodollar, which has long been used to settle international oil transactions and could potentially play well for gold as the main countries not only have significant reserves but having been net buyers of Gold for the last years, or for Bitcoin which is permissionless and could benefit countries with high energy production.

Precious Metals-Backed Cryptocurrencies

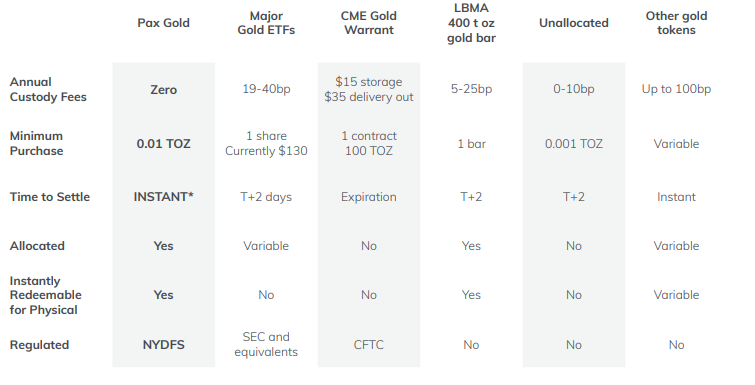

For those not wishing to go for the Old Timer’s option of acquiring the metal itself, there is the alternative of cryptocurrencies backed from gold or silver; stablecoins as their price is tied to the market price of the precious metals. Overall, this category of cryptos is formidable to anyone wishing to make a long term investment without having any extra space or capital to store them and most are built on the Ethereum blockchain.

The concept isn’t new with Digix Gold founded in 2014 launched in March 2016 with Digix DAO (DGD). The project has developed an additional cryptocurrency, Digix Gold (DGX). Its price is equivalent to 1 gram of gold and can be exchanged with other cryptos or actual physical gold. It’s part of the Ethereum Ecosystem and its tokens are in the EIP20 format.

That is history though as of 21 March 2023 Digix has ceased operations and redemption facilities have been taken over from NexusGold FZC. For the time being DGX is still traded but its future seems uncertain.

Perth Mint Gold Token (PMGT) was the only option that, in addition to zero fees, had reserves guaranteed by the Australian government and also featured physical delivery. Unfortunately this token is being phased out and existing users/owners are encouraged to redeem their token for gold or fiat equivalent.

Pax Gold (PXGD) is your next best option, the renowned stablecoin issuer also has a similar alternative with also the previously mentioned features. The physical redemption is done through the London Bullion Market Association (LBMA) with zero custody fees.

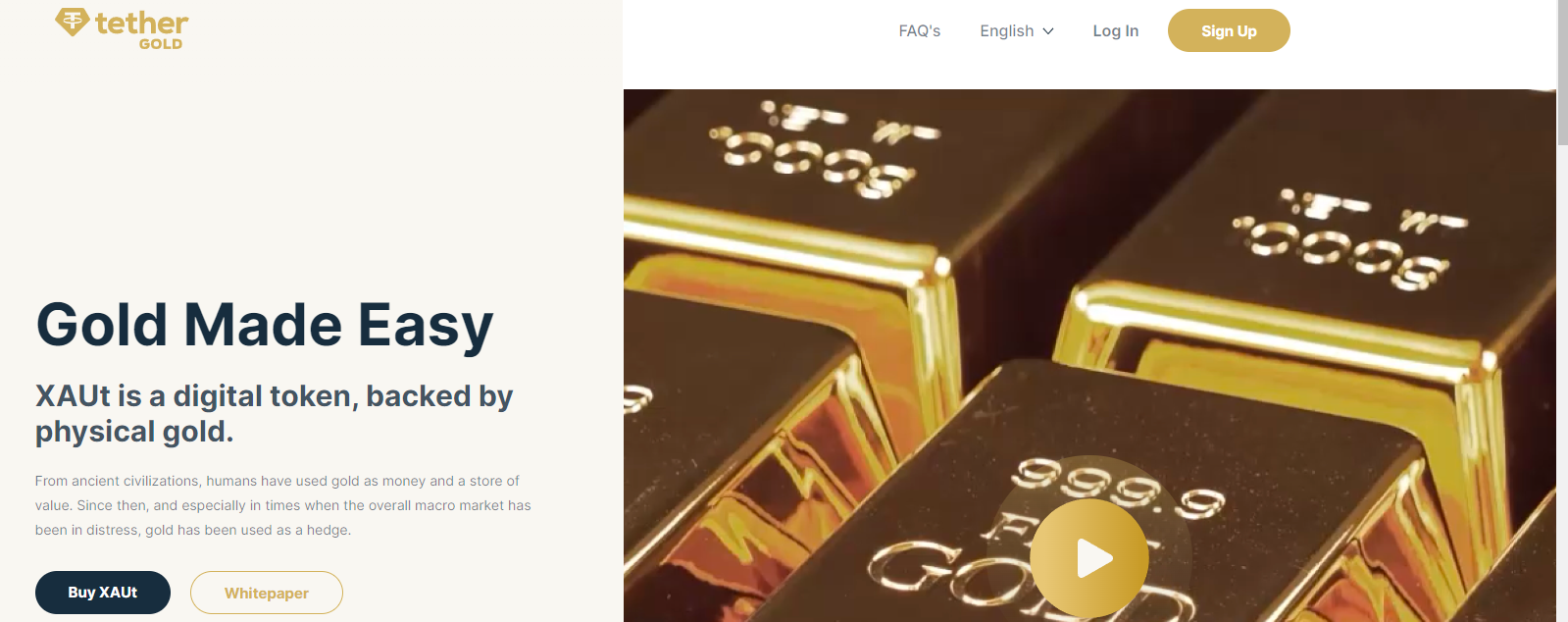

Tether Gold (XAUT) is naked as the name indicates, created from the Tether team and once you purchase any amount of it you will hold undivided ownership rights to the equivalent amount of gold on specified gold bars. One token’s price represents that of one troy fine ounce of gold on London Good Delivery bar. It is transferable from one on-chain Tether wallet to another and XAU token is ERC-20 token held on an Ethereum-based wallet and as a TRC20 token on the TRON blockchain. At any time the tokens can be redeemed to physical gold delivered to any address in Switzerland.

Sliverlink (SLV) and SilverCoin (SC) are two stablecoins backed obviously from silver. The first is no longer with us. The latter is the first silver-backed crypto, can be purchased from an Ethereum wallet without KYC and can be redeemed for 99.99% silver bullion at any time at a price of one ounce Silver American Eagle. Silverlink is equal to one gram of 0.999 certified silver which is acquired at the lowest spot price across markets in Australia, China, Chile, Mexico, Peru and Russia. It's built on the Ethereum network and requires an ERC-20 compatible wallet.

The biggest advantage of these gold/silver tokens is that you can easily sell it on the international market to somebody else on the other side of the world, which isn’t really possible with physical gold. At this point it is also important to explain that the crypto equivalents of paper gold introduces another counterparty risk.

Despite what these sites may claim, the regular auditing and considering the zero fees structure, it is likely you would be buying a IOU (abbreviation of I owe you) for gold/silver, or in other words a debt; a debt whose repayment is linked to the capacity of the company to repay it. Traditional precious metal custodians charge roughly around 1-2% fee for storing gold or silver, if these companies are able to offer zero fees, it could potentially mean that they may issue more tokens than the reserves they have at a certain time; which in turn will at best, significantly delay your physical redemption.

Buy Precious Coins with Bitcoin and other Cryptos

Metal or commodities backed cryptocurrencies are a convenient option but your investment will remain one way or another online. What if you want to take them completely out of the system? In that case there are a few options you can find online. If you search for “Buy precious coins with Bitcoin” or something along these lines, they will present themselves to you.

Following Bitcoin’s and other cryptos' surge in popularity, many bullion exchanges have started accepting them. Worldwide known and trusted exchanges like Suisse Gold or Mike Maloney’s GoldSilver are only a couple of the numerous available options. These are safe options but that brand name guarantee does come with an extra cost; similarly to purchasing British gold sovereigns from a bank. It’s legitimate, safe but a bit more pricey especially with the conversion costs the exchange has to undertake. The solution is to buy straight from another person; cost-effective but risky.

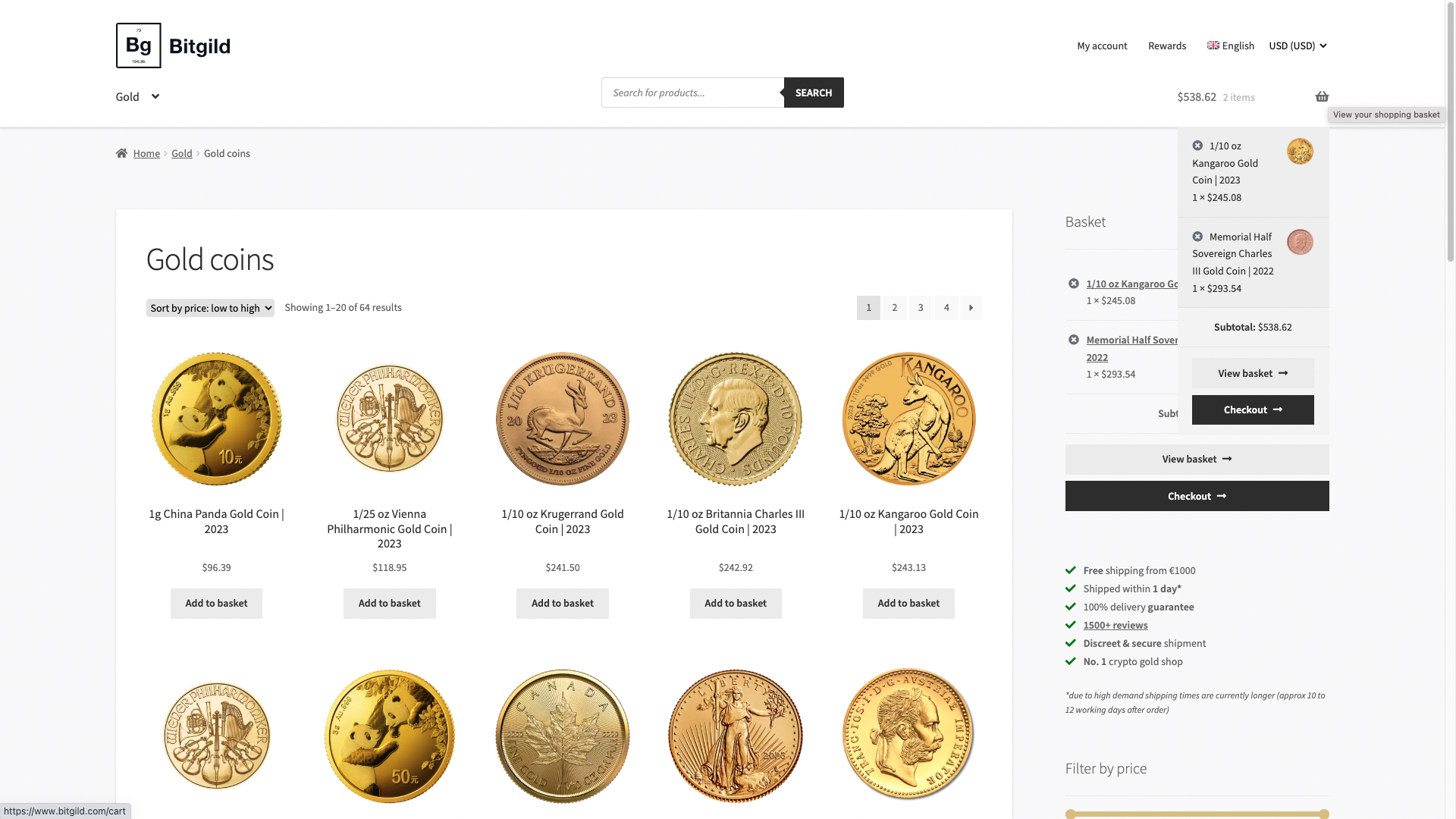

Bitgild

Bitgild deals with this issue very effectively. In essence it’s a platform allowing peer-to-peer Bitcoin to gold exchanges adding an extra layer of trust. All merchants available there have been double-checked from the exchange but in addition to that, you can easily find real customers’ reviews adding an extra layer of trust. Considering Bitgild has been around since 2017, it has a very robust track record.

To purchase a coin or bar, you add it in your basket, fill in your billing and delivery details and choose your preferred method of payment. Apart from Bitcoin and Ethereum, the following stable coins are available: BUSD, DAI, MATIC, USDC, USDT and Altcoins which you can use via Coinpayments. If for any reason you don’t want to use crypto, SEPA Bank transfers and Credit Cards are also available but why use them? Unless there is a special reason, it doesn’t make sense to choose Bitgild, if these are your preferred methods.

Its main drawback is it has relatively few options. The precious coins available are almost all golden and only if lucky you can find silver options. Then, while the gold coins available are enough to say the least, the gold bars available are limited. Nevertheless, it remains a great way of turning your crypto digital stash into a golden real one. Lastly, despite asking for personal billing and of course delivery details, when dealing with low amounts, no other verification apart from email is needed. Therefore, it can be used as an anonymous way of turning cryptos into a physical form of money.

BitDials

An alternative to BitGild is BitDials. Unlike BitGild, BitDials has a much bigger variety of products ranging from luxury watches to fancy jewelerry and of course gold bullions and coins but lacks variety in coins. There are almost exclusively only golden coins and zero to none platinum or silver ones. However, it's very possible you will find there coins which aren't available in BitGild and their options in terms of gold and silver bullions is equally good. Therefore, it's worth giving it a quick look at least.

Conclusion

Nowadays Gold and Silver have a better prospect than they did centuries ago, there are less deposits being discovered and there are no new territories to colonize, so a significant supply increase of this metal is unlikely, until space mining and sea mining become feasible and legal.

The one key point readers should consider is that these metals have intrinsic value, there is significant demand for these metals for the industrial and jewelry sector but an even higher monetary demand from central banks and people around the world.

The one drawback is that the buyer doesn’t really have a way to verify what he is getting, a Bitcoin is a Bitcoin there is no way to have a counterfeit Bitcoin; a “gold coin” may not be made out of gold or it could just be missing a few grams. If you can ever visit a flea market or numismatic fair you will see some buyers examining coins for weight, size and at best testing it with a magnet, some people don’t even bother to inspect the coins, consider that one of these buyers may end up being the person who eventually ends up selling you, potentially fake gold.

The correct way to test for gold is through a very expensive X Ray machine and another one for electric conductivity. Having this in mind it is essential that you consider the upcoming multipolar world order, that the BRICS countries have large gold reserves (and some are receptive towards BTC) but also that their citizens have a gold appetite (UAE & India) and finally consider buying only from reputable sites and diversifying into different assets that can be verified (Bitcoin).