This obviously isn’t a dead end, since you know it’s likely that at least one of your exchanges will accept deposits in that particular cryptocurrency. Nevertheless, you wonder if it would be possible to swap that “X” token for a “Y” token (in a different crypto network) without having to go through an exchange and probably going through two trading pairs.

Well, you are in luck, there are several cross chain swapping services that will allow you to swap with minimum fees, but first, let's have a look at the already known options..

Option One - Sell it

First you would need to go to coin info sites such as Coinmarketcap, and find out (in the markets section of that coin) which exchanges take deposits of that particular coin. You will then need to compare exchanges in terms of trading fees and minimum withdrawal amounts and withdrawal fees. It’s likely that you will be able to get your desired coin in that same exchange but if it isn’t listed, you may need to send it to a second exchange and incur in additional fees.

Option Two - Swap & Bridge it:

Another way of converting coin A for coin B is to use DeFi applications to swap for your desired crypto: A bridge is a link between two networks that allows for an asset to be swapped between networks. In a way, coin A is frozen/locked in chain A while a synthetic copy of it is issued in chain B, to be able to transact and interact with the B ecosystem.

For example if you were looking to place some money in the DeFi ecosystem of Cronos and had only native Ethereum, you would need to bridge the ETH in the Ethereum network, to ETH in the Cronos network through the Crypto.com Defi wallet. Only then you would be able to interact with the Cronos DeFi app’s to swap or trade.

These Decentralized-Finance apps allow you to swap your coin X for coin Y in the same network: In the case of Bitcoin for example, a synthetic version of it exists on the Ethereum network as WBTC which subsequently exists in other EVM compatible networks such as BNB and Cronos. Meaning you would be able to swap that synthetic Bitcoin for any other synthetic coin in that chain, while taking advantage of the lower transaction fees.

Now keep in mind that bridging isn’t free, every bridge has significant network fees. Also, you are probably going to want to get the native version of your desired coin (instead of a synthetic version of it), so you would need to factor an additional bridge back to that native chain or a transfer to a custodial exchange (with additional withdrawal fees if you plan to self custody).

Option Three: Automatized Non-custodial exchanges

For those who find that all of the above sounds too complicated or time consuming there is a way to directly swap from coin “X” in network “A” to coin “Y” in network “B”.

As the name indicates, non custodial exchanges do not hold your funds and automatically transfer coin “Y” once there is 1 confirmation that coin “X” has been received. These types of exchanges do not require KYC verification or account creation, just a simple send X there, to get Y here:

Step 1 - Compare

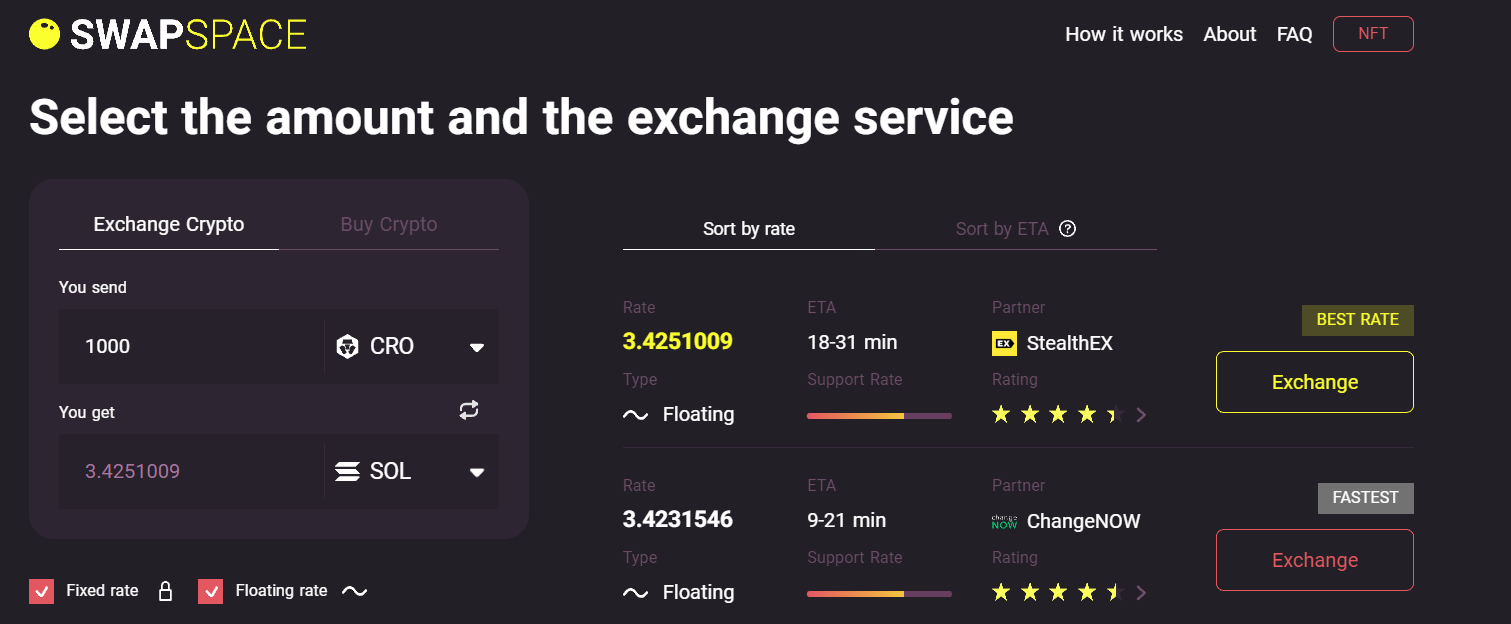

The first step to take is to use an exchange-aggregator, such as Swapspace. Aggregators compare the fees and minimum size for desired coin pairs. Simply pick the coin you intend to provide or “sell”, and pick the coin you would like to receive in return.

In the example below, we are trying to swap CRO on the Cronos chain to SOL in the Solana chain. The exchange rate at the time was 1000 CRO = 3.4251 SOL for the top vendor and relatively similar rates with other providers.

It is important to clearly understand the fees and the level of support that the listed vendors provide. The fees are clearly disclosed but in terms of reputation/support you can start by looking at their reddit and other social media channels, as well as contacting them through the live chat on their site. Sometimes the vendor with the best rate may not be the option that provides the best service.

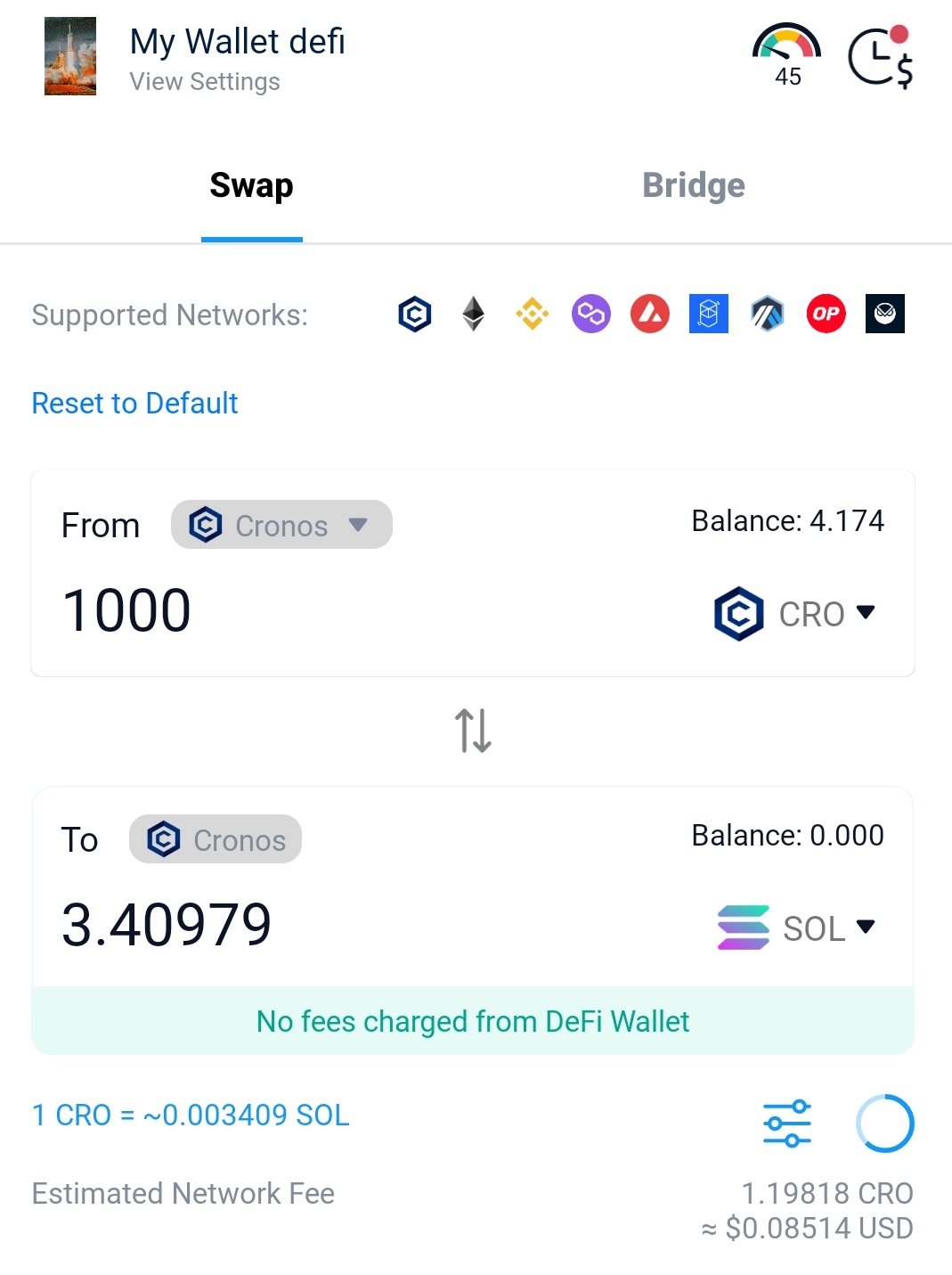

Now if we go over the Crypto.com Defi wallet and try swapping CRO on the Cronos Network for SOL in the Cronos Network, we get a rate of 1000 CRO = 3.40979 SOL. Remember that’s not native Solana yet, it’s a synthetic version of the native Solana, which you may want to bridge back to its original network. Sadly in this case, Cronos doesn’t have a Solana bridge yet, which means we will have to go through the Crypto.com app/exchange to be able to withdraw it, so you can factor in a 0.0005 SOL withdrawal fee.

*You won’t need to bridge the synthetic SOL as the exchange lets you deposit and withdraw SOL on all the networks it supports, but the withdrawal fee will depend on the network you choose.

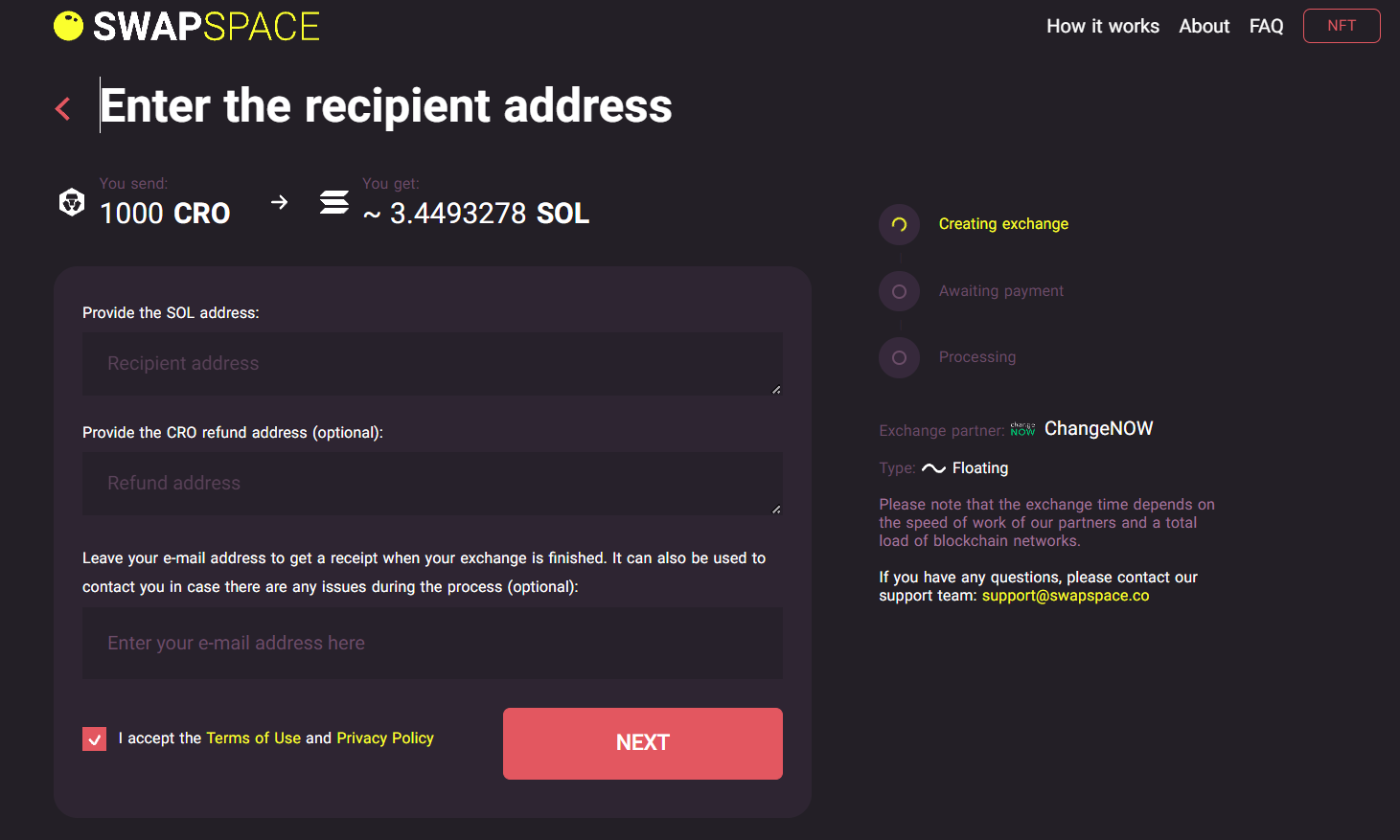

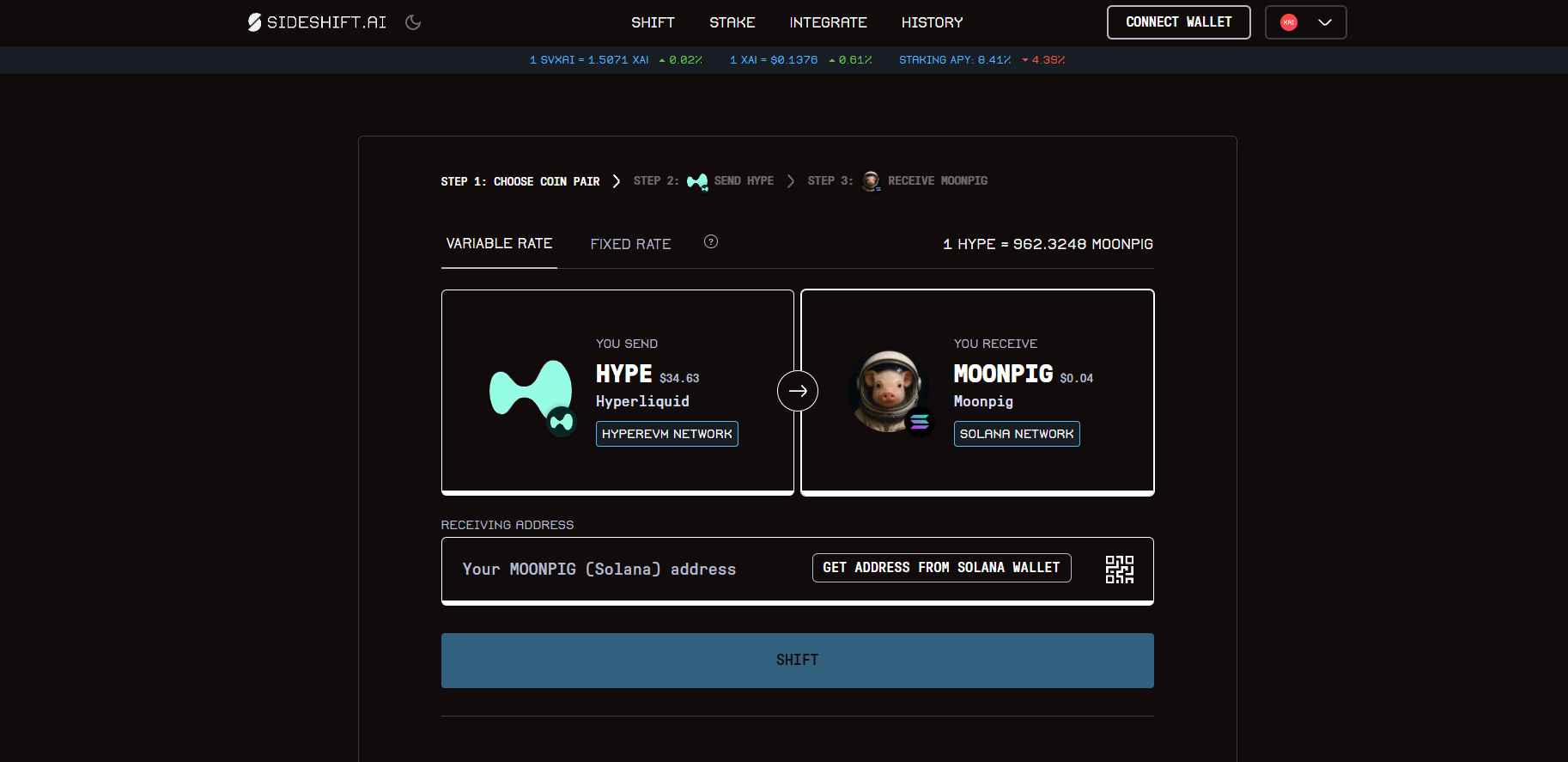

Step 2 - Provide a destination address

Once you have compared the vendors and selected one, simply click on the “Exchange” button and follow the instructions.

First, you have to provide the recipient address: This is where you will receive the new exchanged coins, a crypto wallet under your control that can be completely unrelated to the wallet you will use to send the payment.

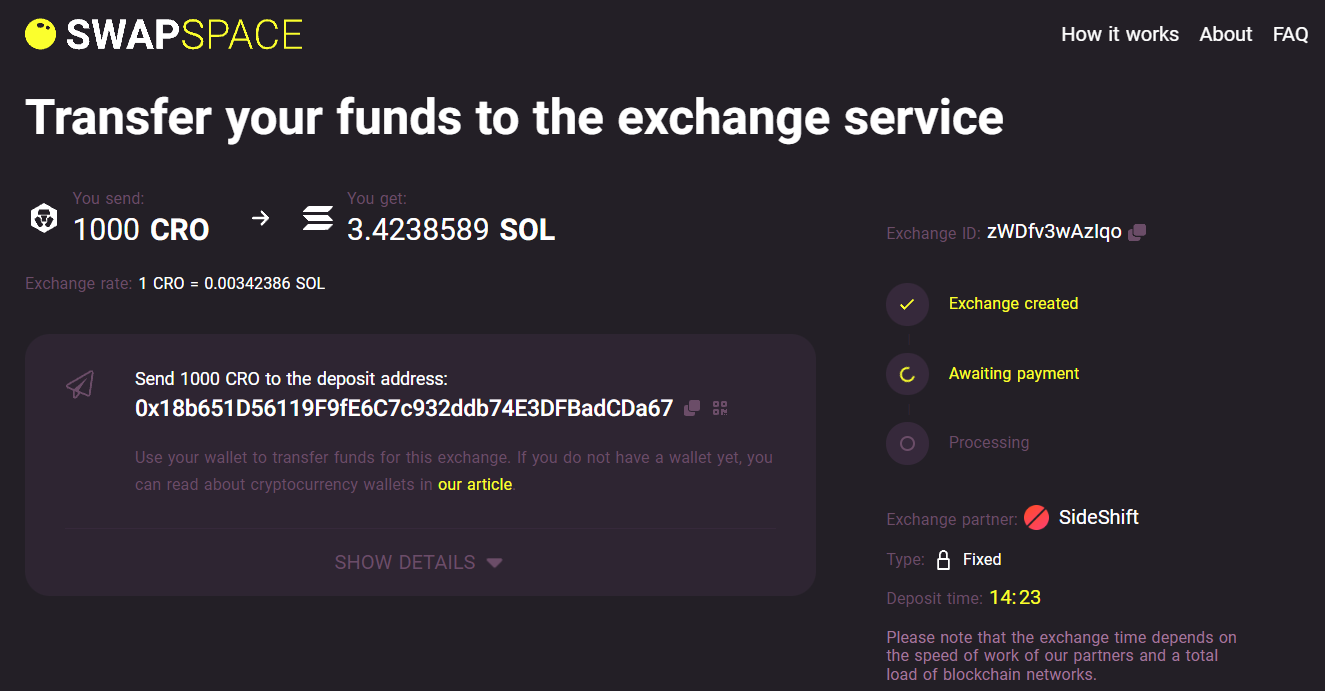

Step 3 - Transfer the amount to be exchanged

You will then be prompted to send the agreed coins to a designated deposit public address within a 20 min window:

Step 4 - Wait & Confirm

When the crypto deposit you made has at least 1 confirmation on the blockchain, the exchange will send the agreed amount to the recipient/destination address you provided.

That’s it, you are done, all you have to do is wait to receive your coins, so make sure to save the transaction ID, until you can confirm you have received the funds in your address.

Cross Chain Swapping Alternatives

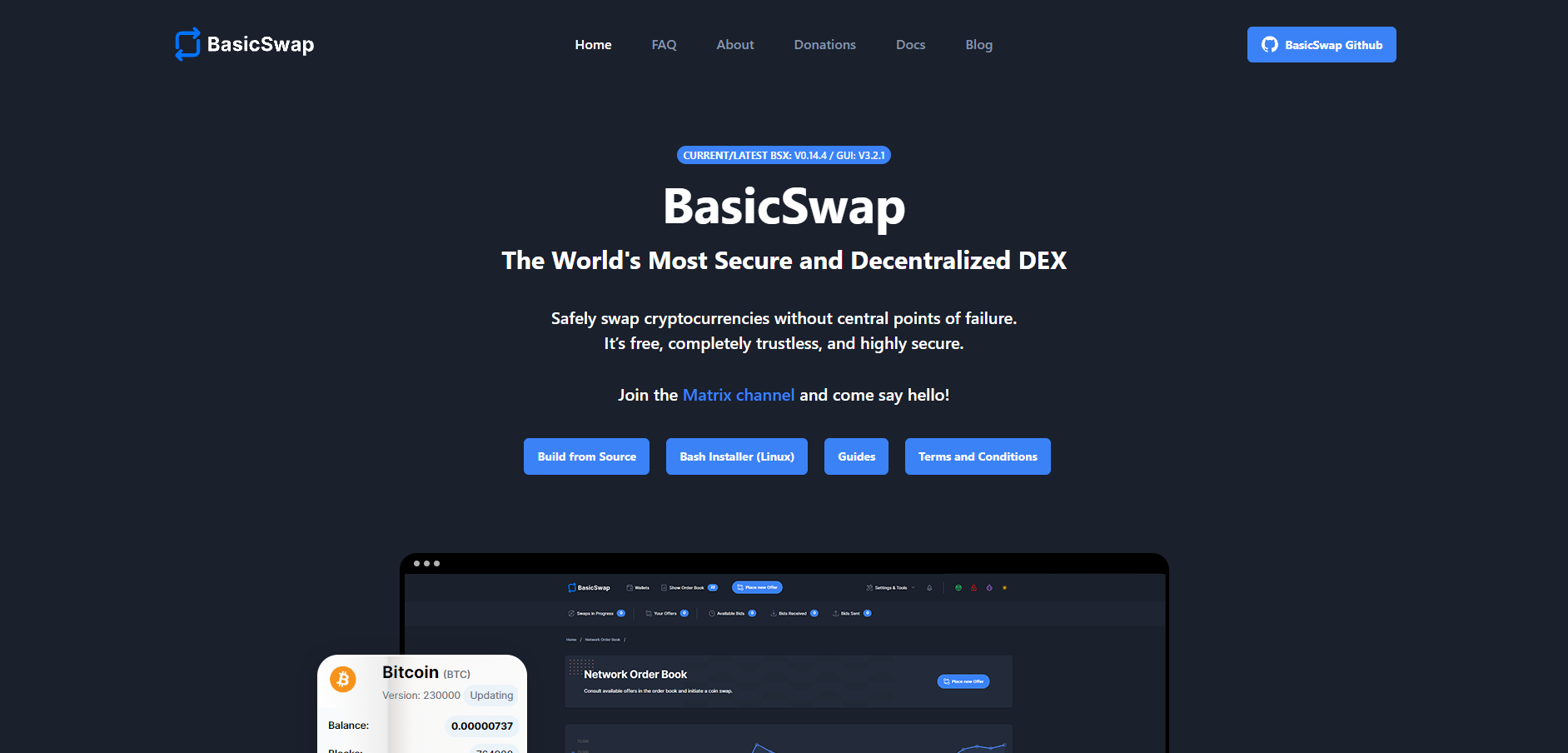

BasicSwapDex | Fast & Safe

For those who prioritize decentralization and control over their assets, BasicSwapDex is a powerful alternative through its non-custodial atomic cross-chain swaps. BasicSwapDex allows users to directly swap between cryptocurrencies across different networks without relying on intermediaries, ensuring that no third party holds custody of your funds at any point during the transaction.

Atomic swaps work by utilizing a time-locked smart contract that guarantees both parties either receive their respective tokens or have their original funds returned if the swap fails to complete. This eliminates the risks associated with traditional custodial exchanges, where users must trust the platform to safeguard their assets. With BasicSwapDex, the entire process remains secure and decentralized, meaning you retain full control of your private keys.

One of the key benefits of BasicSwapDex is its ability to facilitate cross-chain swaps without requiring account creation or KYC verification, aligning with the principles of financial privacy. Whether you need to swap Bitcoin for Monero or convert another pair of cryptocurrencies across different chains, BasicSwapDex ensures a seamless experience with minimal fees.

By keeping your funds in your wallet until the transaction is complete, BasicSwapDex provides a high level of security, making it an ideal choice for those who prefer to manage their own assets.

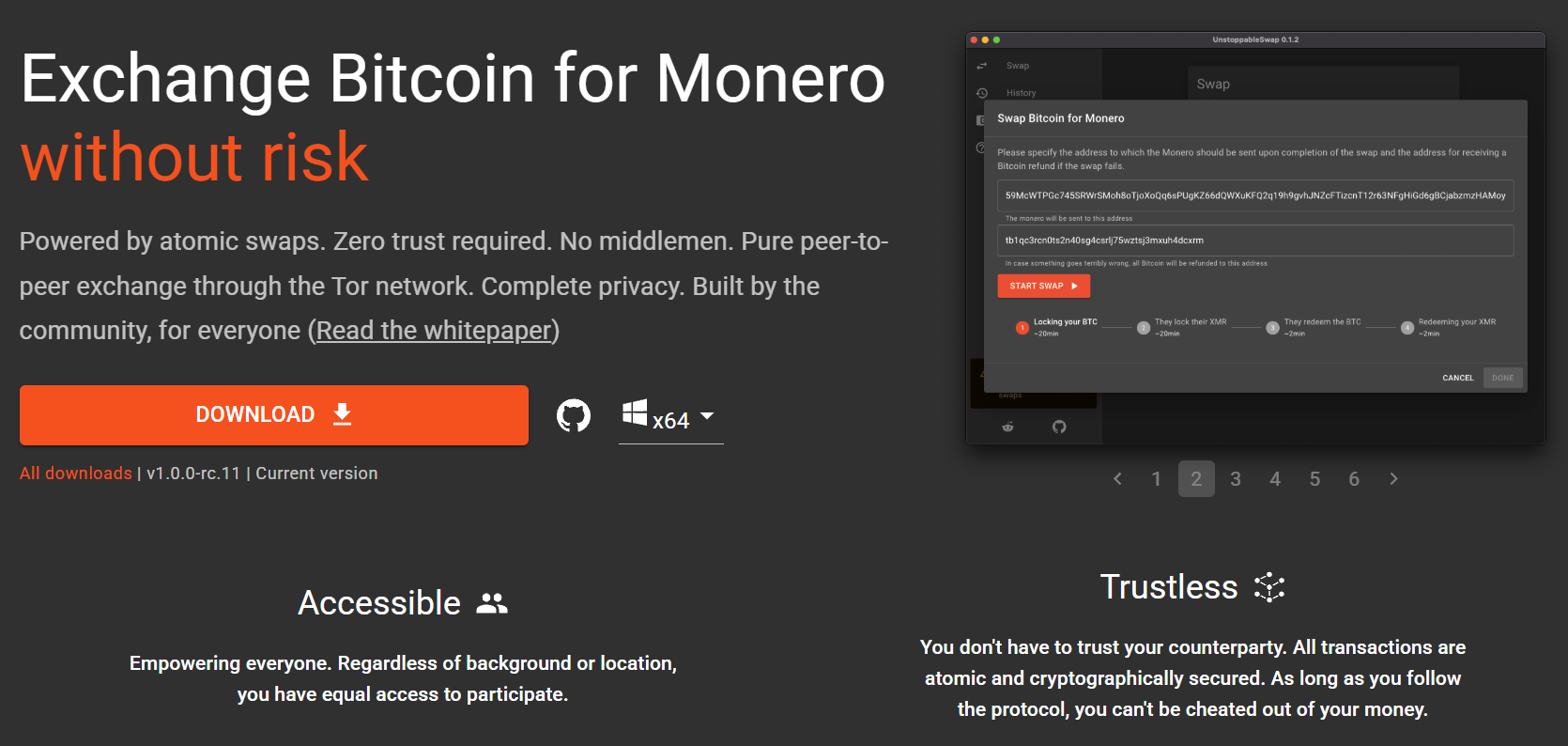

Unstoppable Swaps | Trustless and Anonymous

Unstoppableswap.net makes swapping Bitcoin and Monero simple and private. By focusing exclusively on these two cryptocurrencies, the platform ensures that your transactions remain anonymous, thanks to Monero's strong privacy features.

Whether you're looking to swap cryptos for a more private experience in crypto gambling or need a secure way to exchange your assets, Unstoppableswap.net keeps things trustless.

You retain full control of your funds with no KYC or third-party involvement, making it a perfect option for those who prioritize privacy in cryptocurrency swapping, all while enjoying peace of mind during your crypto transactions.

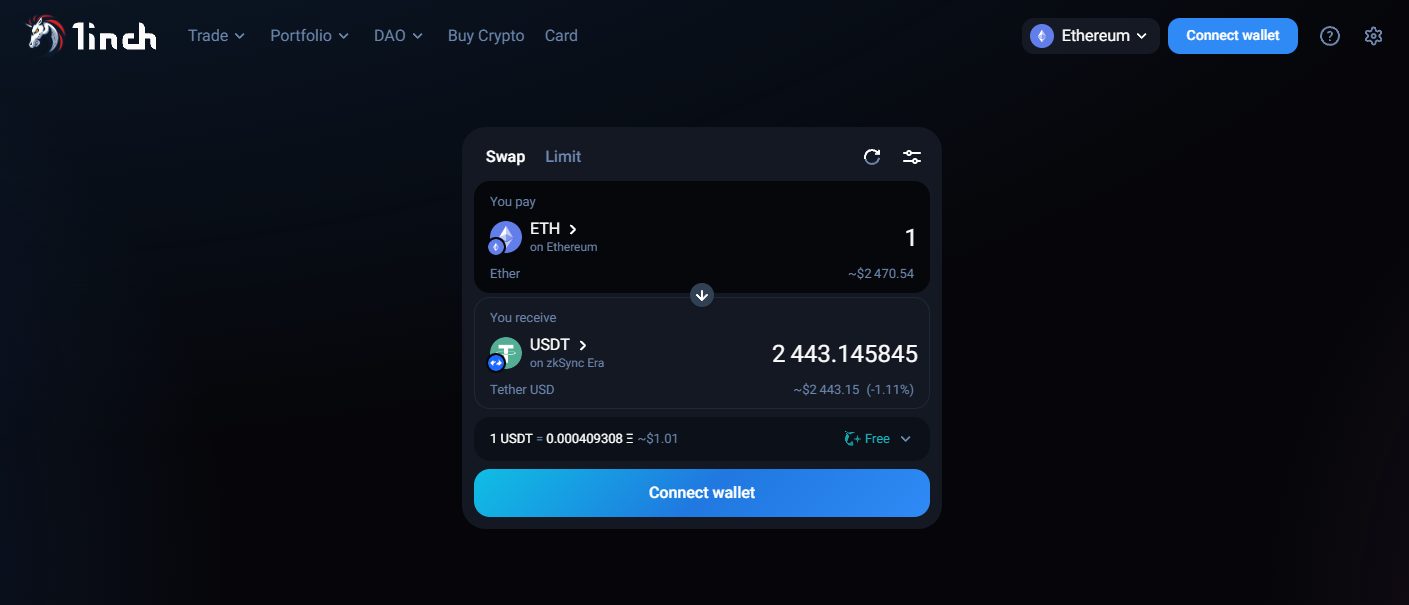

1inch | Cross-Chain Cryptocurrency Swapping

For those looking to swap cryptos efficiently across multiple blockchains, 1inch is a top-tier option. As a decentralized exchange (DEX) aggregator, it finds the best swap rates by scanning multiple liquidity sources, reducing slippage and fees.

With support for Ethereum, Binance Smart Chain, Polygon, and more, 1inch makes cross-chain cryptocurrency swapping seamless. Its Pathfinder algorithm optimizes transactions, making it a great choice for users involved in crypto gambling who need fast, cost-effective swaps.

Since 1inch is non-custodial, users maintain full control of their funds, ensuring security and privacy in every transaction.

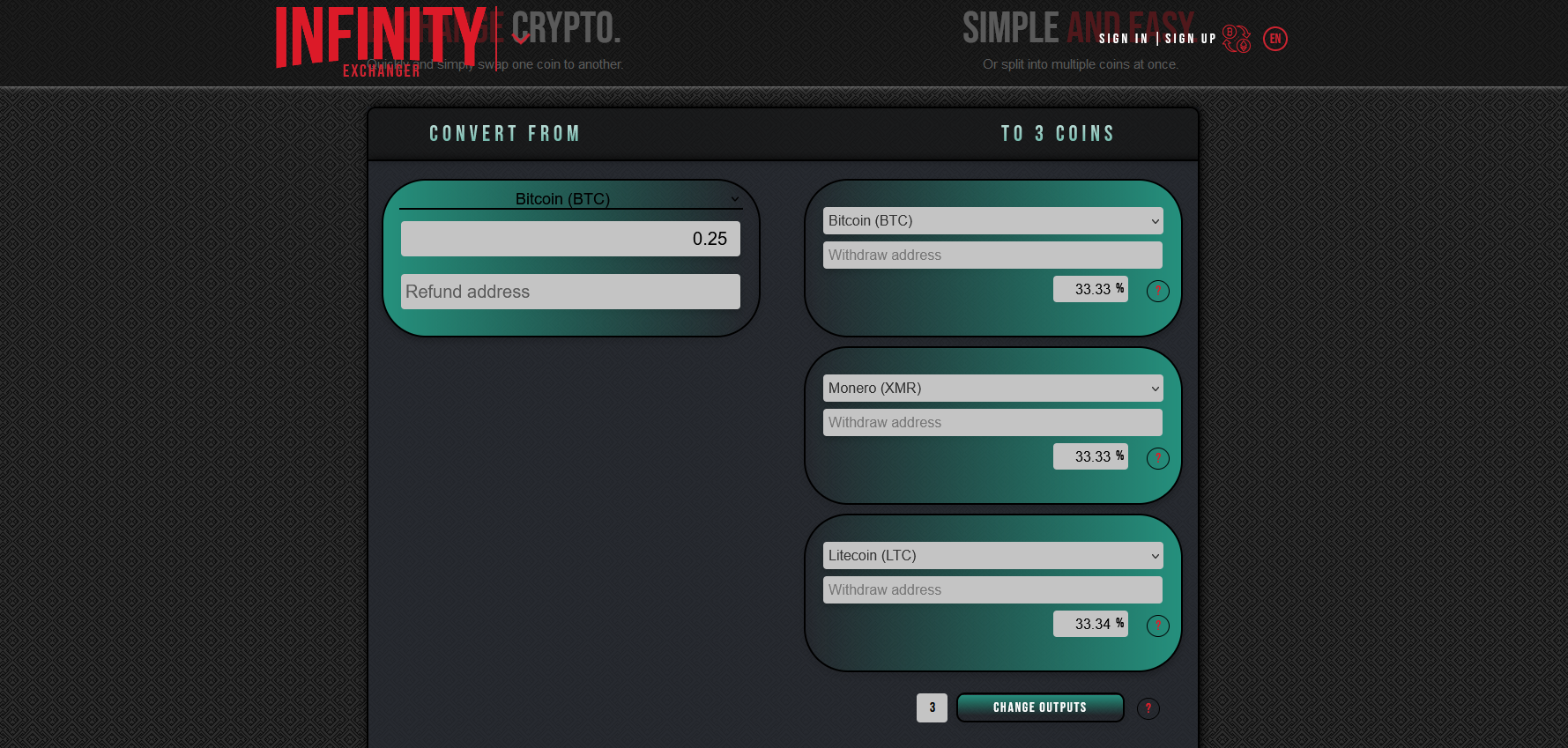

Infinity Exchanger | Private Multi-Coin Swaps Over Tor

Infinity Exchange is a Tor-only platform focused on privacy and anonymity. It enables users to swap cryptos like BTC, BCH, XMR, and LTC simultaneously in a single transaction, using multiple outputs to make cryptocurrency swapping significantly harder to trace. This feature is especially valuable for privacy-conscious users involved in crypto gambling or seeking secure, trustless swaps. With no KYC, full self-custody, and a stealth-first design, Infinity Exchange is ideal for those who value discretion and control in every transaction across popular coins.

SideShift.ai | Instant Non-Custodial Crypto Swapping

SideShift.ai is a seamless, no-signup platform that lets users swap cryptos instantly across chains—perfect for those navigating the world of crypto gambling. With no KYC requirements and a user-friendly interface, SideShift.ai supports automated, non-custodial cryptocurrency swapping between assets like BTC, ETH, and stablecoins. It’s a fast, efficient alternative to bridges and DeFi platforms when you want to exchange coin A for coin B across networks—without the hassle or exposure.

What are the Risks ?

As with anything in crypto, things can go wrong, this process isn’t as robust as a Bitcoin transfer and it may easily have attack vectors that could put your transferred funds at risk. As previously mentioned it is important to consider the reputation and conditions of the vendors before executing any swaps.

We noticed one particular case regarding FixedFloat (an automatic non custodial exchange) in which they were accused of scamming one user by not providing the desired coin after the initial transfer. The official response is that the company was contacted by crypto partners regarding the funds provided by the user, which were stolen funds from a hack; the user was then informed of the steps to take in order to clarify the source of the funds in case it was a mistake. Indeed any company in the space may withhold your funds, or in this case payment, if the crypto you provide comes from illegal activities.

Also make sure to get the correct link for the aggregator and bookmark it to avoid any additional risks. Websites can be easily replicated almost identically, and as you may have noticed in social media and search engines: anybody can pay for advertisement space that links to fake sites.

Finally, remember that there are no support agents on social media sites that will contact you directly. Legitimate support agents only operate through their own platform/email and will never ask you for payments.

Bonus Tip: Enhancing Privacy and Security in Crypto Swapping

When using swapping aggregators for cross-chain swaps, many providers offer incentives like referral bonuses or reduced fees. Taking advantage of these can help optimize your experience and save you money. However, it's important to remember that in the fine print of these platforms' Terms & Conditions, there may be data collection practices that could lead to your information being sold to third parties. Ensuring all your traffic is encrypted is crucial, especially in cryptocurrency swapping and crypto gambling, where your data is at risk.

For better privacy, using a VPN is highly recommended. It masks your IP address, preventing platforms from tracking your swap history or collecting personal data. If privacy is a top concern, consider routing your connection through Tor Browser (desktop), Orbot (split tunneling Tor “VPN” for apps) or at the very least using a double or triple VPN setup for additional security.

Additionally, ensure proper wallet hygiene by avoiding the consolidation of balances or reusing the same wallet addresses. While Tor or a VPN can hide your IP address, failing to follow these steps may still allow your public addresses to be easily linked.

Conclusion

In the example above, using automated non custodial exchanges was less expensive than using custodial exchanges or DeFi swaps. However, the rates could easily be more beneficial through centralized exchanges depending on the coins and volume of it.

Automatized non-custodial exchanges are not better than custodial exchanges 100% of the time but rather an additional alternative that may be more convenient for you and should be considered. We believe that non custodial exchanges are a great alternative for smaller amounts and a good incentive to self custody your own assets. For larger amounts however, the increased security, as well as the incentives for trading volume may provide a more robust solution.