How Cryptos and Altcoins Work and their Differences

Cryptocurrencies are digital tokens that work as part of a blockchain network. There are no central servers or dedicated authorities to oversee transactions. Hence, the services are free from hefty taxes, transaction charges, and other fees. Bitcoin is the most famous crypto token today. Although altcoins like Ethereum, Dogecoin, and Ripple are quickly gaining ground.

However, traditional cryptocurrencies are volatile, and the recent Bitcoin prices are the best example. Bitcoin prices tend to rise and fall with investor sentiment. And several factors like government regulations, demand vs. supply, media attention, and investment moods severely affect the prices.

Stablecoins differ from traditional cryptocurrencies in that their value is tied to an asset. These are most commonly linked to stable fiat currencies like the USD or gold and other assets. The second most common type of stablecoin is algorithmic, meaning that the prices depend on the demand and supply between the stablecoin and the crypto token bolstering it.

Stablecoins: Traits and Characteristics

Stablecoins are a viable alternative to crypto tokens, but they are generally used for investments and not for digital transactions. These currencies peg their values to external references using a fiat currency. And they are more reliable since their value doesn’t entirely depend on investor sentiment.

Stablecoins may use commodities like gold or an algorithm to control supply. They keep reserve assets on hand to boost value and control supply. Tether is the most common stablecoin used globally and is available at all the top crypto exchanges. Let’s walk you through some of the notable features of stablecoins.

Privacy

Stablecoin transactions are anonymous. Hence, pinning their ownership to an individual or organisation is difficult. They offer advanced privacy levels since it’s impossible to associate them with company-related or individual data.

Security

Stablecoins offer advanced security levels, so your transactions stay anonymous. You can store tokens in software and hardware wallets using a private key. Therefore, stablecoins are more secure than fiat currencies.

Usability

Stablecoins are gradually being used for transactions. Several tools and services now allow faster transactions from crypto to fiat currencies. Hence, you can use your wallets to convert stablecoins through your preferred exchanges.

Decentralisation

Decentralisation is one of the best features of stablecoins. Just like cryptocurrencies, stablecoins are cheaper and safer to use and they don’t come under the purview of government control.

Types of Stablecoins

There are several types of stablecoins on the market. Let’s look at the top three variations based on the stabilising mechanism.

Fiat-collateralised stablecoins

As the name suggests, fiat-collateralized stablecoins gain value from notable currencies like the USD, GBP, and HKD. Other major collaterals include gold, silver, and crude oil. USD remains the most popular collateral, and independent custodians are responsible for storing and auditing the currency’s value. Tether USD and True USD are the best examples.

Crypto-collateralised stablecoins

As the name suggests, these stablecoins draw their value from other cryptocurrencies. But since cryptocurrencies are highly volatile, these tokens tend to be over-collateralized. This means that their reserve funds are valued higher than the actual token’s value. For instance, crypto tokens worth $2 million might be stored to issue stablecoins worth $1 million.

Algorithmic stablecoins

These stablecoins may or may not have reserve assets. Instead, their value is retained by controlling the flow of coins. A computer programme is in charge of continuously analysing the demand vs supply graph, and controlling the flow of currency to prevent its value from dropping significantly. This is quite similar to how the Reserve Banks control fiat currencies.

Widely Accepted and Safe Stablecoins

These are the seven most popular stablecoins on the market today.

Tether (USDT)

Tether is one of the world’s top stablecoins that draws its worth from the USD, gold prices, and cash equivalents. Tether is known for easy integration with payment platforms and low transaction charges. Hence, it’s the most common crypto wallet for online gambling.

USD Coin (USDC)

Also called the digital dollar, USDC is secured using short-term US treasuries and cash. The conversion rate is 1:1 and many US financial institutions store the reserves. USDC is rarely used at online casinos. Although, you will find several top operators accepting USDC transactions.

Binance USD (BUSD)

Binance USD is a 1:1 stablecoin that draws its value from the USD and gold prices. BUSD is a bridge between decentralised and traditional finance, and it protects investors from inflation and rampant price fluctuations.

True USD (TUSD)

One of the most liquid stablecoins on the market today, TUSD is 100% backed by the US Dollar. The currency commands a lower transaction fee than its rivals, making it one of the most popular digital-transition currencies. The coin is also pegged to other prominent regional currencies like AUD, GBP, and HKD.

DAI

One of the best decentralised stablecoins available today, DAI is soft-pegged to the US dollar. Its value depends on collateralized debt from Ether, which helps reduce investment risks significantly. DAI is primarily used as an investment vehicle and is not popular for digital transactions.

Pax Dollar (USDP)

USDP, another USD-tethered stablecoin, trades at a 1:1 exchange rate with the fiat currency. Pax Dollar was created in the face of the Tether crisis and has grown significantly since. It’s quite popular at online casinos and is accepted by most major operators.

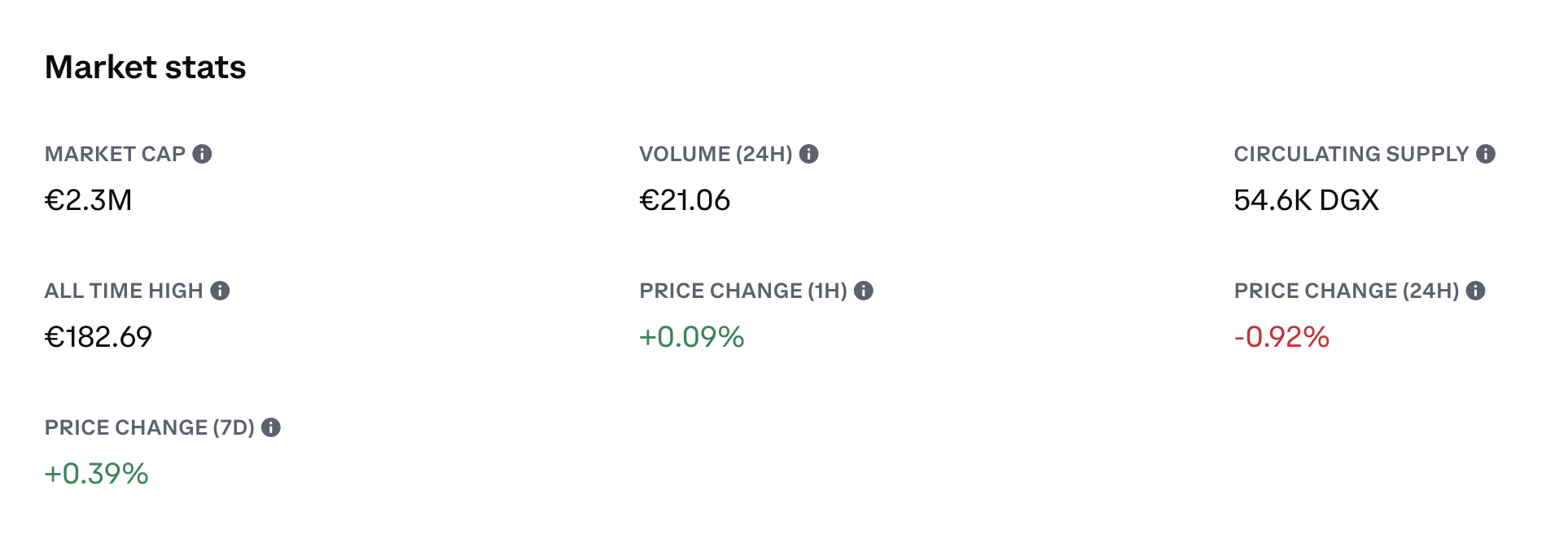

Digix Gold Token (DGX)

Aside from USD, gold is the most-used asset linked to stablecoins. Digix Gold Token is one of the most popular stablecoins used today, and its value is measured in physical gold stored at the company’s vaults in Canada and Singapore. DGX is primarily an investment vehicle and is rarely used for online transactions.

What Makes Stablecoins Unique

Stablecoins share several unique traits. Here’s a detailed analysis of what makes them different from other cryptos.

Unit of account

One of the fundamental things to remember when analysing stablecoins is the manner in which they stabilise the currency. Pegging plays a crucial role in pricing stablecoins. Hence, they can be used as an alternative to fiat currencies.

Medium of exchange

Stablecoins offer a more realistic medium of exchange compared to cryptocurrencies and could encourage their adoption. Moreover, they reduce the risks of volatility and improve convenience. Their use in digital transactions could foster the scope for mass-scale adoption in the future.

Value Storage

Unlike cryptocurrencies, stablecoins are less volatile, meaning they retain their value over time. This is a crucial trait that could further boost their use as a digital currency and promote confidence among depositors.

Performance analysis

Another important characteristic of stablecoins is performance valuation. Since stablecoins take away the volatility from cryptocurrencies, they can quite accurately assess the performance of projects.

Interoperability

Stablecoins are flexible and can be used with dApps. Businesses using smart contracts could benefit from greater predictability and reduced operational costs, while interoperability with dApps could offer better prospects in terms of infrastructure management.

Conclusion

Stablecoins have significantly boosted the demand for cryptocurrencies, especially as an investment opportunity. They are a valuable investment vehicle and have removed the drawbacks of crypto investments. And since their value is pegged to fiat currencies and other assets, you can enjoy all the perks of investing in crypto without worrying about losing your investments overnight.