Back in 2019 and up until July 2022 Celsius Network’s motto was “Unbank Yourself” and aspired to become an alternative to traditional banks. Or at least that was the marketing message. Its CEO Alex Mashinsky (whose personal webpage just disappeared overnight) who interestingly was born in Ukraine and has a Jewish ancestry, was presented as a “highly successful, high-net-worth serial entrepreneur” whose creations “have almost certainly had a big impact on your life already”. Yahoo, Forbes, Bloomberg, CNBC and other world known news outlets were and are still praising him. So how is it that someone like him fails so badly with cryptos?

My experience with Celsius

I decided to write about Celsius because I had a bad experience with the wallet a few months before its bankruptcy, thanks to which I saved the small stash I was keeping there. For safe alternatives read iPlayCrypto's best crypto wallets.

Going back to how I started with Celsius, it was back in 2018. A colleague of mine, who was deeper into cryptos, suggested the wallet because it was safe, easy to use on mobile and I would get free CELs. Without giving it much thought I downloaded the app and transferred my bitcoins there. The verification process was smooth and made me feel safe while I was getting fresh CELs every week. Back then I was a newbie not using cryptos for payments much but saving them. So I hadn’t really tested Celsius’ functionality.

That was until March 2022 when it all started. I wanted to move my stash to my ledger wallet for safety reasons. I accessed the wallet on my desktop with my VPN active and then added the withdrawal address. Without any notification my account was blocked. The reason was that they detected suspicious activity being the addition of the withdrawal address from an unknown IP. Despite me sharing all the information one would need as to how this happened they insisted on me recording a video holding my ID card requesting the change and the specific withdrawal address.

The whole idea of “unbanking oneself” is to make our life easier, not ridicule us. I exchanged emails with them for more than a month. Eventually I had to record three videos, as the first two weren’t good enough for them, but they eventually allowed me to cashout. I withdrew everything I had in the wallet as to me this was a clear sign that Celsius shouldn’t be trusted. I don’t care where they are registered and which billionaire supports them. If you don’t let me cash out easily, bringing up “security concerns” then you aren’t trusted to keep a single dollar.

They say one who sacrifices freedom for safety deserves neither. While I respect some corporations’ efforts to appear legitime to the public and do everything by the book for security guarantees, I can tell whether those regulations put in place are to protect me or limit me. This is the same reason Bitcoin was launched in the first place.

Bankruptcy and recent developments

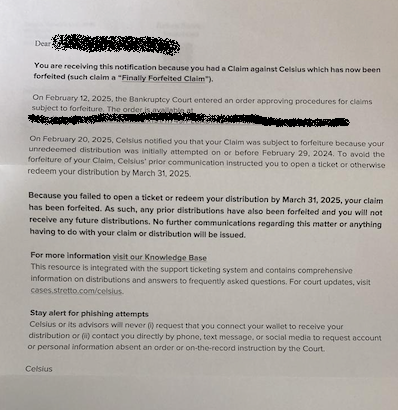

Fast forward to October 2022 and a lot of things have happened since. While transactions were blocked since June, on July 14th the first “Important Community Update” newsletter was sent stating that Celsius voluntarily filed petitions for Chapter 11 reorganization under New York’s southern district court. The email continued claiming that withdrawals, swaps and transfers on the platform were paused to protect users as otherwise a few would be able to withdraw their balances first and the rest would lose them.

Now the case is at New York’s court and while there is some positive news that users may get back a fraction of their coins, based on past events, this isn’t very likely. To help its user base Celsius published a YouTube video explaining how people can claim their coins back. It's funny how this isn’t called a bankruptcy but a “restructuring process” or that your real account balance might be different from what you see on the app for “a variety of reasons”.

In addition to that, not only did they lose your coins but now all users’ details are with New York’s state authorities. In other words, any level of privacy or anonymity that Celsius was offering has evaporated and the government has access to users’ personal information; amounts, addresses, names, everything as a result.

This isn’t the first time crypto hodlers read an email saying they can’t use their coins for their own protection. Mt.Gox and BitFinex are still discussed. Moreover, the huge drop from over $65,000 per bitcoin in November 2021 to under $20,000 in mid June 2022, would lead to such problems inevitably, right? Bitcoin’s volatility has been a big issue for many years now driving people to stable coins instead.

That’s the story one notices with a first read of the events but is that the case?

It was recently announced that Alex Mashinsky will not be left unemployed but continue his entrepreneurial endeavors at JPMorgan Chase & Co. After all, before filing for bankruptcy, Celsius stock was up by 2,500% in three years which is objectively a great success.

Lessons Learned

Celsius proved once more that cryptocurrencies are very dangerous, at least that’s what is said. On iPlayCrypto we see the exact opposite. Cryptos remain safe and are the main solution to our fraudulent financial system.

First things first, don’t go for the free coins. Indeed numerous people are attracted to staking as it’s an easy and relatively quick way to grow your stash. In most cases though this is too expensive to maintain and sooner or later the provider either has to stop or file for bankruptcy. For free coins you can try faucets or airdrops as your risk there is literally zero.

Avoid giving your coins to US registered corporations. It’s known that the central government doesn't like cryptocurrencies as they empower the common citizen in an unprecedented way. The moment the state has the chance to somehow damage the crypto industry or get information on people using it, they will use it. Unfortunately, even with cryptocurrencies there will be some level of state involvement even if it’s at the last stage of a cashout. What hodlers should do is make sure to use products and services which are not so easily reachable from governmental agencies.

Now it’s not just the US authorities fighting cryptos. The UK, European Union and China have also repeatedly tried to hurt crypto hodlers. Nevertheless, if you are an American citizen holding cryptos in a Hong Kong based exchange, you will probably lose your coins in the event of a bankruptcy but at least the IRS won’t know about it.

The most important lesson to learn for the gorillionth time is to avoid corporate products and look for genuine solutions not supported by investment funds and “experienced people in the industry”. When you pick a casino, you read about the bits you are interested in and then make a decision. A similar approach should be applied to all your choices; gather the necessary info and then decide. Don’t rely on third parties to step in and do the dirty work for you. In this case what appeared to be an advantage, wasn’t so. Many people probably decided to use or invest in Celsius thanks to the certainty Mashinsky’s name provided but is that so? Indeed throughout his career he has been a very active entrepreneur with numerous awards including the Albert Einstein Technology Medal in 2000. In other words he was and is a person of the market.

That is good for boomers wanting to invest in some “new fintech stuff” but not for what cryptocurrencies mean to us. Bitcoin was introduced back in 2008 to overrule the current financial system or exist as an alternative alongside it. Celsius was implying that but in reality it came from the same industry it’s supposed to disrupt. There are still many dots to be connected but given what has happened, the blocked accounts, transferred coins after bankruptcy, personal details revealed, unmatching balances, Wall-Street connections, this doesn’t seem like just a bankruptcy caused from cryptos’ well known volatility.

Conclusion

Cryptocurrencies are often associated with ponzi schemes, money laundering, drug dealing and other illegal or harmful activities. This is partly true thanks to the anonymity and absence of a central bank, transactions can’t be controlled empowering criminals. However, criminals succeeded in doing so well before the Bitcoin whitepaper. Cryptocurrencies are a tool and depending on how you use them they can be beneficial for you and society or not.

Remember to not trust your cryptos with corporations or industry leaders. Use their services only when necessary and then move your coins to a safe option like a hardware wallet.